Diversification

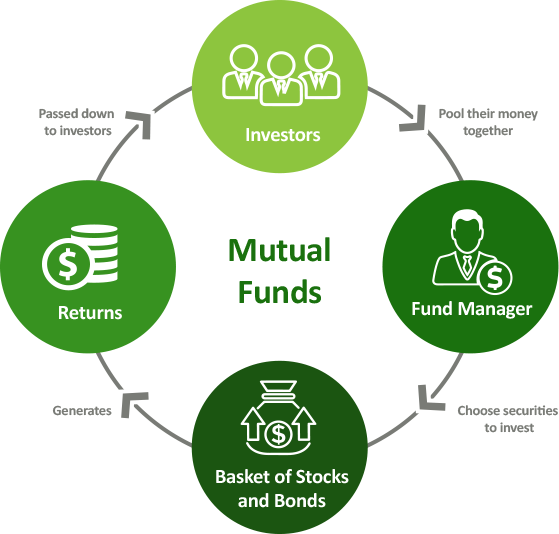

Mutual Fund is a basket of securities such as stocks and bonds, actively managed by qualified fund managers who carefully choose the assets under the mutual funds and continuously rebalance them to deliver the desired growth and to achieve the fund goals.

When you invest in mutual funds, your money will be combined with other investor’s money, and you will own a share of that fund. It is one of the best ways to invest in financial markets if you don’t have the required knowledge of choosing individual stocks, or don’t have the time to manage your investment.

Mutual funds have gained popularity over the past few decades as many funds have delivered a constant growth and decent returns.

There are many types of Mutual Funds in the market. Some of them invest in a specific sector such as technology or healthcare, a specific market such as Asian or US market or a specific strategy such as income or growth.

As a UAE resident, you have access to invest in the local, regional and international market Funds.

For more detailed information, check out: ALL YOU NEED TO KNOW ABOUT MUTUAL FUNDS in UAE

If you want to invest in the international mutual funds and get access to hundreds of excellent performing funds, you can either contact your bank to ask if they provide access to international funds, or you can ask a financial adviser to show you the available and best performing funds that match your risk profile.

The financial adviser should give you the best advice of which funds to choose, how to invest in them and what is the best time to exit.

Check out some of the best performing funds over the past few years:

If you are new to trading and unsure where and how to start, you can connect with one of the Forex professionals and have a discovery chat.

It’s completely free with absolutely no commitments to work with them in the future.

Local investment firms in the UAE offer a wide range of funds which have the exposure to the local & regional markets in the MENA and GCC region throughout funds managed by best-in class fund managers.

Here are some of the most famous investment companies which provide access to the local & regional funds

If you would like to discover more about investing in the local and regional Mutual funds, you can request a FREE discovery call with one of the experts. They will answer your questions and provide you with all the information you need to know.

Click here to request a call back from the advisor