Description:

Trading 212 is a global Stocks & ETFs broker. Clients also can trade Forex and CFD. Founded in 2004 and regulated UK Financial Conduct Authority (FCA) and the Bulgarian Financial Supervision Commission (FSC). The UK-based company offers a high quality trading platform with good features and competitive fees.

Regulations & Licenses:

Trading 212 UK Ltd. is registered in England and Wales (Register number 8590005), with a registered address 107 Cheapside, London EC2V 6DN. Trading 212 UK Ltd. is authorized and regulated by the Financial Conduct Authority (Register number 609146).

Trading 212 Ltd. is registered in Bulgaria (Register number 201659500). Trading 212 Ltd. is authorized and regulated by the Financial Supervision Commission (Register number RG-03-0237).

Products:

Trading 212 offers a wide range of products. Once you open an account, you can start trading the following:

- Stocks (you own the underlying stock and not a CFD)

- ETFs

- Currencies

- Commodities

- Indices

- Cryptocurrency

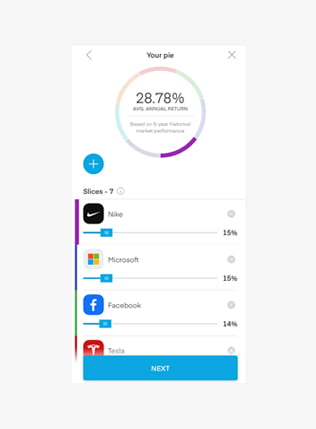

What is Auto Invest & Pie Trading?:

It’s a systematic way where users can choose between hundreds of stocks & ETFs to build a diversified portfolio and customize it based on their goals.

After choosing the stocks or ETFs, the platform will show the estimated returns based on the historical performance.

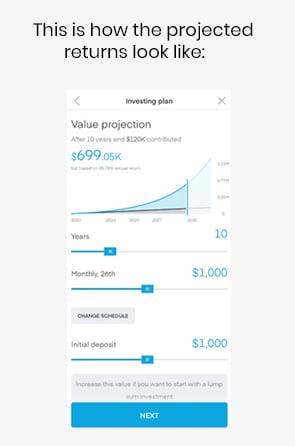

After deciding on the pie, users have the choice to either manually add manage the future deposits on this pie, or to automate it so the amounts they decided will be automatically added to the pie on a monthly basis.

The platform will also show the projected returns based on the planned monthly investment and the years of contribution.

Minimum Deposit:

There is no minimum deposit.

Account Opening Requirements:

- Proof of identity: national ID, passport or driver’s license

- Proof of address – a bank statement or a utility bill issued in the last three months

Fees:

Trading 212 allows you to own the real Stocks & ETFs (not CFD) with zero fees.

Also, Trading 212 doesn’t charge a non-trading fee.

Bottom line, Trading 212 is considered a low fee broker.

Customer Service:

Customer support is available via calls, email and live chat.

Trading 212 has a responsive and very good customer support.

They offer support in a multiple languages including English, German, Dutch, Spanish, French, Italian, Polish, Serbian, Norwegian, Swedish, Czech, Russian, Romanian, Turkish, Arabic, and Chinese.

Deposits & Withdrawals:

Trading 212 accepts the following payment methods:

- Debit / Credit cards

- Paypal

- ApplyPay

- GooglePay

- Skrill

- Bank Transfer

Education:

Trading 212 offers the following:

- Demo Account

- Tutorial videos of the platform

- General educational covering different topics such as reading charts, trading modes and economic indicators

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.