National Bonds of UAE: All You Need to Know

National Bonds of UAE refers to an organization that is totally owned by the Dubai Government that offers bonds to the public. Primarily, the National Bonds was formed by the Government of Dubai.

The main aim of the organization is to provide a form of investment that offers returns at a low risk. The role of the National Bonds of UAE is instrumental as it targets generation of financial wealth by the masses.

National bonds programs are available for UAE Nationals (Emiratis), resident expatriates and non even for anyone who lives abroad.

To purchase a national bonds, you must be older than 21 years of age.

For minors, the parents and/or legal guardians can only purchase the savings bond on their behalf

There are no restrictions regarding the minimum income to be eligible to buy bonds, anyone with any income is eligible for investing in National bonds.

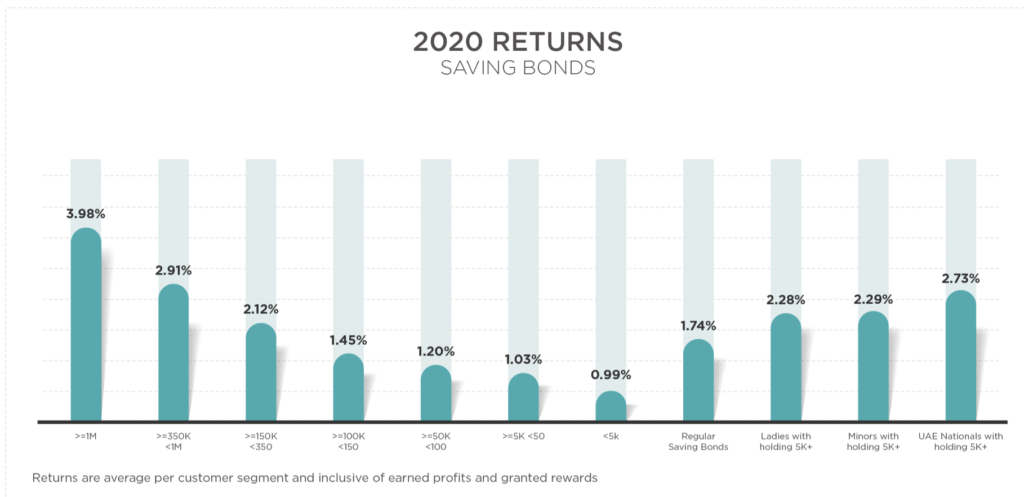

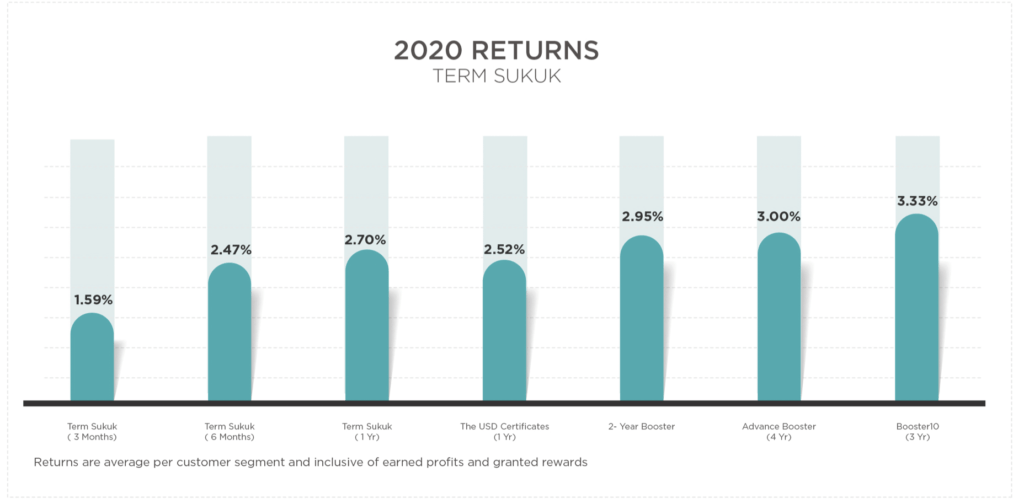

National Bonds rewards longer tenures more. Thus, the longer the duration for saving the more returns you get.

The profit rates grew year on year from 2014 and more promising results are expected.

*www.nationalbonds.ae

*www.nationalbonds.ae

*www.nationalbonds.ae

*www.nationalbonds.ae

The growth in profit rates is due to investments in various projects. Essentially, the profit rates are higher in comparison to interest rates from the banks with the purpose of the profits being to grow your savings.

National Bonds of UAE has a wide array of products for your personal finances. The products all aim at ensuring you secure your funds and get a return from it. Some of the products include:

The savings bond is an affordable product that allows you to save as you desire. There are saving certificates that start from AED 10 that you can buy. By saving using this product, you can get yearly profits. Additionally, you are eligible to enter the National Bonds Reward Programs. As long as you are a UAE national and are 21 years and above, you can get this product easily.

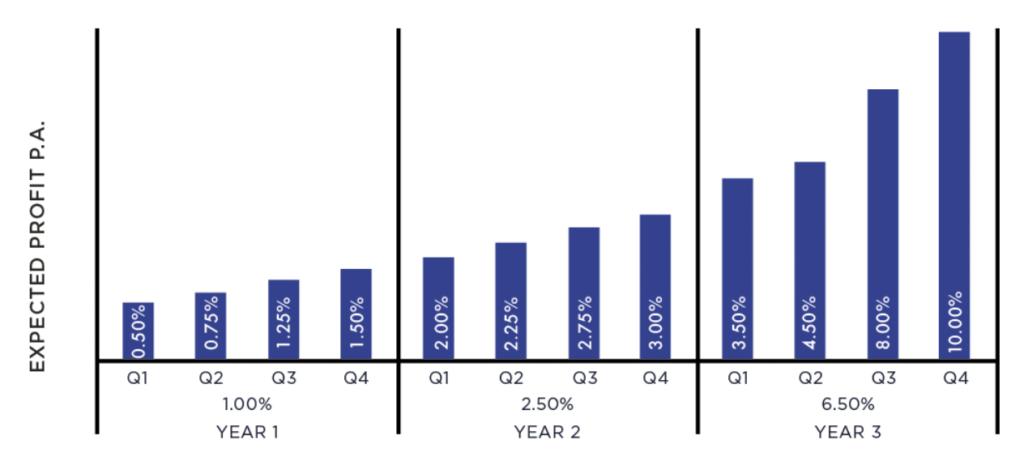

Investing in this plan starts from AED 10,000. The profits are distributed every quarter, the returns are high and investors in this product are eligible to enter a. withdraw of 8 Millionaire draws and 16 luxury car draws, yearly.

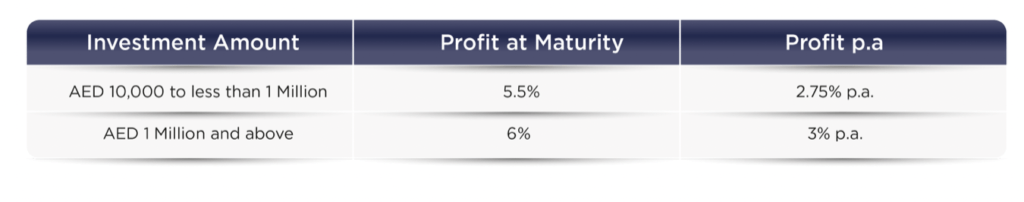

The below chart explains how Booster 10 works

*www.nationalbonds.ae

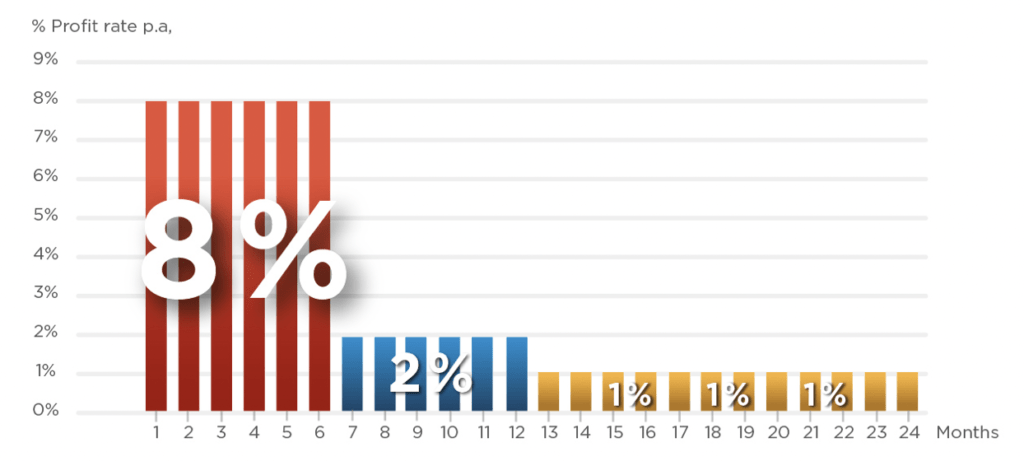

The payout product involves investing money in a 2 year plan that offers upto 8% in profit for the first 6 months. You are able to obtain your profit monthly and are free to redeem. Further, the Payout product offers capital protection and as such is a low risk product.

The below chart explains how Payout works

*www.nationalbonds.ae

2 Year Booster is a product that offers returns after you get to two years. The return is calculated as 6% payable on maturity. The minimum capital required to invest is AED 10,00 and you have the freedom to redeem early.

To be able to obtain returns in advance, National Bonds has a product that gives you advance returns of 3% per year. The plan is for 4 years but the profit is made available before the 4 years are over. You are also able to redeem the payments early if you need financing.

There is no doubt that having funds secured for your child is vital for planning purposes. Well, the Education Plan is meant for this purpose. By saving using the plan, you can realise profits that further increase the funds.

To be able to determine the amount to contribute to the plan, you consider the duration of the plan. If you want to save for a long period, the monthly payment is low while short tenures mean that the annuity is higher. The product has low risk and aims at capital preservation. You do not need to worry about your child’s funds as you invest your savings into the future.

You can invest as much as you want in National Bonds, however, the minimum investment is 100 AED, where you can get 10 bonds for AED 10 each, or even a single bond at 100 AED.

One of the distinguishing features of the National Bonds is its Reward Program.

Usually, the Reward Program entails a 2-4 lucky draws per year. If you are an investor, you can make a claim on your investment. The gift ranges from AED 50- AED 1,000,000. If you have invested a huge amount for a long period, you could be among the lucky investors.

The most recent reward program in 2020 had exciting offers. More than 64,000 bondholders won prizes. Among the exciting offers were 12 Tesla Cars, AED 35 Million and 4 Nissan Patrol.

Low risk Investment– The fact that National Bonds are a Government Security makes it a low risk Investment.You are sure of payment as the credit risk is minimal. The government initiative aims at encouraging savings and offering returns on them.

Average returns– In comparison to most savings accounts in the UAE, National Bonds offer attractive profits on your savings. The Advance Boost 12% offers returns of 12% over a 4 year tenure which can elevate your funds further.

Sharia Compliant– National Bonds of UAE is Shariah compliant. You can be sure that your investment is within the threshold of safe borrowing and facilitates social responsibility.

In order to generate more profit, National Bonds has invested in some projects. The Skycourt real estate projects in the UAE involves AED 1.6 billion. The development will improve the social economic status of Dubai while at the same time generating profit.

Another venture by National Bonds is the unique Soul Extra. The development aims at providing space both for government businesses and local businesses while generating profit.

The asset allocation for National Bonds involves main allocation in Deposits, Fixed income , Real Estates for Yields and Equities. Most of its investment is in the local industries.

National Bonds is compliant with many regulations. Among these is the anti money laundering framework that guides their investment undertakings.

Some of the methods that National Bonds employs include “ Know Your Customer” for customer identification, flagging of suspicious activities, looking at risk factors in terms of product and the investor. Overall, you can be sure that your funds are not subject to money laundering activities.

National Bonds offers a great option for your savings. In comparison to banks, you can get higher returns on your savings if you invest in its product. In fact, National Bonds of UAE remains at the top of the many organizations and will give you a run for your money.

Additionally, bondholders enjoy saving with a Sharia Compliant scheme. National Bonds tailors most of its product to meet varying needs of its investors. If you are looking for a long tenure investment, the education Plan is a great option. The 2 year boost can work for you if you want an attractive return on your savings for two years.

There are different ways to buy National Bonds of UAE:

1. visit www.nationalbonds.ae, and buy online,

2. call the sales team through 60052279.

3. Through exchange houses such as Al Ansari Exchange

4. Through National banks in UAE

Yes, especially if you are looking for safe investments and not willing to take risks. National Bonds offers a great option for your savings. In comparison to banks, you can get higher returns on your savings if you invest in its product. In fact, National Bonds of UAE remains at the top of the many organizations and will give you a run for your money.

Additionally, bondholders enjoy saving with a Sharia Compliant scheme. National Bonds tailors most of its product to meet varying needs of its investors. If you are looking for a long tenure investment, the education Plan is a great option. The 2 year boost can work for you if you want an attractive return on your savings for two years.

The organization offers its bonds to the general public including:

For National Bonds of UAE, there is no restriction on minimum income. Rather, you can save any amount and get a positive return out of it.

Redeeming your National Bonds involves a simple process. You log into your account on the website www.nationalbonds.ae. Click on instant redemption. Use your mobile number and password to gain access. After that, select the amount you wish to redeem.

Alternatively, you can visit a UAE exchange to be able to redeem your National Bonds at any of the branches. Also, you can visit AI Ansari Exchange to redeem your savings account.For partial redemption, NBC will offer you a certificate with the balance.

The minimum period after which you can redeem your savings certificates is 30 days if you bought it using cash. However, if you used credit financing, 90 days should lapse before you redeem.

International Contact: +97148348000

UAE: 600522279

You can always talk to a Financial Advisor and explain your financial situation to help you achieve your financial goal. Usually, Financial Advisors have access to products that you wouldn’t have and can suggest some great options tailored to your specific circumstances.

Check out our recommended list of financial advisors in UAE and have a free discovery call with any of them.