How to Invest in Index Funds in Dubai (2024 update)

Looking to diversify your investment portfolio in Dubai? Let’s discover the index funds and how they can be a game-changer for your financial strategy.

Index funds are financial instruments that track the performance of particular index, such as the S&P 500. They provide broad market exposure and usually have low operating expenses.

But how to invest in index funds in Dubai, and can it be the right investment for you? We’ll find out in this article!

In financial market terms, an index is a method created to track a group of stocks’ performance.

It is a hypothetical portfolio of securities representing a specific market or a part of it. So when people say the market is up or down, they are referring to an index.

The index can be broad-based, capturing the entire market or more specialized such as indexes that track a specific industry.

Some of the most famous indexes:

S&P 500: This is a popular index that tracks 500 of the largest companies in the US. It’s a good way to see how big companies are doing..

FTSE 100: : This index looks at 100 of the biggest companies in the UK, so it’s a great way to check the health of the UK market.

Dow Jones Industrial Average: Tracks the performance of 30 companies from different industries representing the largest and most widely held publicly traded companies in the US.

Since investors cannot invest in the index directly, the index fund tool has been created.

Index funds are a mutual fund or exchange-traded fund (ETF) with a portfolio constructed to match or track a particular index such as the S&P 500.

Index funds typically use a passive investment strategy, which means their objective is to deliver similar returns to the index they are tracking.

Index funds may track markets, such as US markets, emerging markets, or Asian markets. Or track an industry, such as technology funds, industrial funds, and electric cars funds. Also, funds can track commodities such as gold and oil.

So if you want to invest in the biggest companies in the US, instead of investing in hundreds of single stocks, you can invest in the funds that track the S&P.

Choosing the right stock to buy is not simple; it requires an in-depth analysis of the financial statements and a good knowledge of the industry the company is working in. Moreover, most fund managers fail to beat the market; therefore, investing in the index fund might be the best choice for many people.

Here are some of the reasons why investing in index funds can be a good fit for you:

Decent Returns:

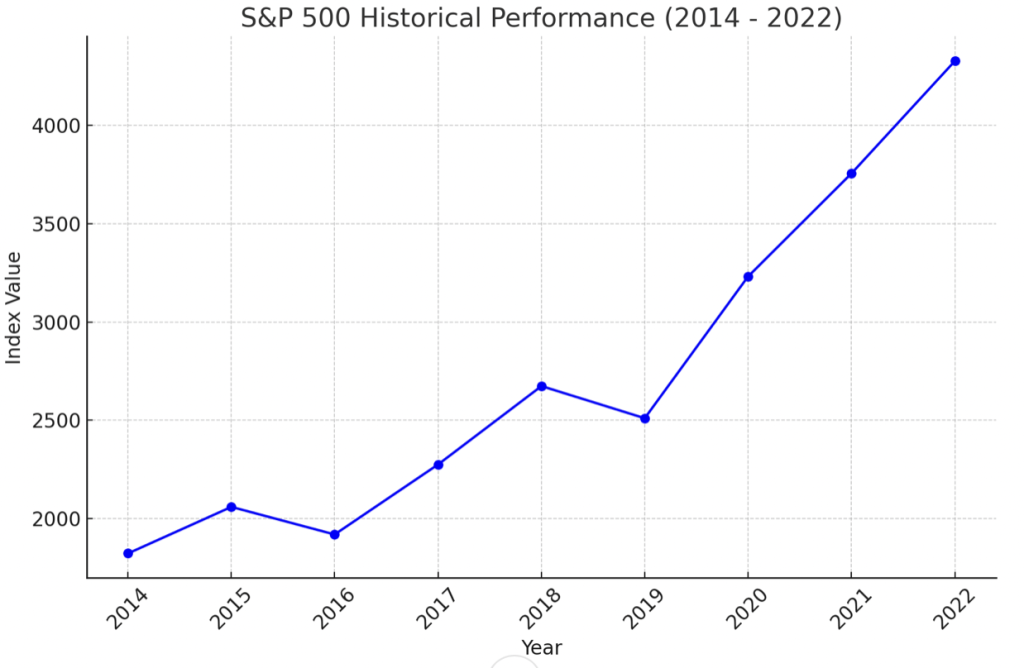

Even though index funds do fluctuate, but over the long term, they proved to make decent returns. Over time, S&P 500 had returns of around 10% annually

Low Risk:

Since index funds are diversified, investing in them has lower risk than owning a few individual stocks. Keep in mind that this doesn’t mean you can’t lose money, but they usually fluctuate much less than the individual stock does.

Low Cost:

Index funds are cost-efficient and have a lower expense ratio than many other funds because they are passively managed.

“There is no free lunch” in the financial markets, and no investment is “perfect,” and that includes index funds.

One of the main drawbacks of index funds is that they rise along with its index and fall with it.

In other words, if you are investing in a fund that tracks the S&P 500, you’ll enjoy the profits when the market is up, but your portfolio will drop when market drops.

On the other hand, when investing with a financial advisor or in an actively managed fund, they might be able to sense and predict a market correction, so they hedge, adjust, or even liquidate the portfolio.

The examples below includes funds from a variety of companies, and it includes some of the lowest-cost funds trading on the public markets.

Index Funds are replicated by ETFs and Mutual Funds. Here are some of the examples:

Vanguard S&P 500 ETF (VOO) – Tracks the S&P 500 (biggest 500 companies in the US)

Fidelity ZERO Large Cap Index (FNILX) – The Fund seeks to provide investment results that correspond to the total return of stocks of large–capitalization US companies.

Invesco ETF (QQQ) – Tracks Nasdaq 100 index, it includes 100 of the largest international and domestic companies listed on the Nasdaq stock exchange

Emerging Markets index MSCI Ishares (EEM) – tracks the investment results of an index composed of large- and mid-capitalization emerging market equities.

You have two ways to invest in Index Funds in Dubai, UAE:

1. Invest in Index Funds by Your Own:

If you have a prior experience in trading and investing, you can invest in Index funds which are replicated by ETFs and Mutual Funds by opening a brokerage account. You can to open an account with one of the following brokers:

• eToro – One of the world’s leading brokers, it offers zero fees for trading stocks and ETFs. eToro enables users to invest in stocks, ETFs, currencies, indicies, commodities and cryptocurrencies.

(61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money)

• Sarwa – is a UAE based company that is gaining popularity in the UAE market. It offers simple and affordable global market investment solutions to residents in the Middle East, including the UAE, Kuwait, Bahrain, and Saudi Arabia.

• Saxo Bank – A popular Danish investment bank, it offers a wide range of products including stocks, bonds, structured notes, mutual funds and ETFs. Saxo Bank requires a high minimum investment of $10,000.

2. Invest in Index Funds with a Financial Advisor:

If you don’t have the time to research and monitor the news and markets, you can use the help of a financial advisor. It’s their job to be always updated with market trends and potential opportunities. You will explain to them your goals and risk appetite, and they will create an index funds portfolio for you and they’ll review it periodically with you.

You can do your own research to find the best financial advisor in UAE. Also, you can check our recommended list. We chose this list carefully based on popularity, good reviews, the strength of the companies they work for, and the range of products and solutions they provide.

Background: Launched by Emirates NBD, one of the largest banking groups in the Middle East, this fund tracks the S&P 500 Index, which comprises 500 leading U.S. companies.

Success Story: This fund has consistently delivered robust returns for investors in Dubai. By mirroring the S&P 500, it provided a gateway for local investors to gain exposure to the U.S. market, leading to significant capital appreciation, especially during the U.S. market bull run in the late 2010s.

Key Takeaway: The Emirates NBD S&P 500 Index Fund demonstrates the potential of index funds in offering Dubai investors access to global markets, diversifying their portfolios beyond local equities.

Index Funds are one of the safest and most rewarding investments only if you consider investing them in the long-term. Make a habit of investing a certain amount every month for years, or work with an advisor and commit with a mid to long-term plan investment under their management.

i have mutual fund but never heard about index funds. invest every month for how much and for how many years? what is the top company to invest? thanks

Hi Jess,

Yes index funds are funds that track a certain index such as S&P 500. You can also invest in ETFs that track the same index, such as Vanguard S&P 500 ETF (VOO), or iShares Core S&P 500 ETF (IVV).

Regarding how much to invest every month and for how long, it all depends on how much you can afford and it’s different from a person to another, however, the longer period you keep investing, the higher returns you might get. Historical charts show how long term investors have been rewarded with much higher returns than the short term ones. All the best!

can i invest directly to the 3 mentioned brokers such as saxo bank, etoro and swissquote? also can they choose for me the right company to invest? which of the three you can best recommend to me? thanks.

Hi Jess, I have sent you an email with the answers on all your questions. Hope it’ll help! expect an email from info@thefinancedean.com

Hi Dean,

Could you share the same information with me as well. I’m really interested in investing in Index funds

Hi Dean, Can I too get an Idea about starting an investment in index funds as a beginner.

Hi Ramez, Please send us an email on info@thefinancedean.com and we can help you out with investing in index funds

Want to invest in index fund

Hi Rahil, Please send us an email on info@thefinancedean.com and we can help you out with investing in index funds

Every single article wriiten in your website is extremely priceless for me and every one who read these articles. God bless you for such kind of best contents and anticipate to read more to your new posts here. I don’t want to get out once I land on your website. Great thanks again and appreciate for your kindness and efforts. ☺

That’s really very kind of you! thanks a lot for such encouraging comments! Hope we remain up to your expectations.

I have invested in multiple Mutual Funds via HSBC uae (they are all actively managed funds however I am concerned about the high annual maintenance fees that I would pay..and if this will have a bigger impact on my returns as the corpus grows.)

I have asked my bank to pause it for now, I am leaning towards going indexing via ETFs.

Am I doing the right thing?

Hi Ali, you are absolutely doing the right thing. High Mutual funds fees can eat up all your returns