Description:

Forex.com is a global FX and CFD broker founded in 2001 works in over 180 markets. The parent company of Forex.com is GAIN Capital, which is based in the US and listed on the New York Stock Exchange NYSE:GCAP.

Forex.com offers a wide range of products such as Stock CFDs, Forex, Commodities, Indices and Crypto CFDs.

Regulations:

The company is highly regulated by the following:

FCA – UK’s Financial Conduct Authority

FSA – Canada’s Financial Services Agency

FSC – Hong Kong’s Securities and Futures Commission

IIROC – Investment Industry Regulatory Organization of Canada

NFA – National Futures Association in the US

SEC – Securities and Exchange Commission

CFTC – Commodity Futures Trading Commission

CIMA – Cayman Islands Monetary Authority

Minimum Deposit:

The required minimum deposit is $100.

Account Types:

- Standard Account

Ideal for traders who want a traditional, spread pricing, currency trading experience. Standard account is the only account that users can use Metatrader 4

- Commission Account

Ideal for traders who are seeking very tight spreads with fixed commissions.

For example, if you bought 200,000 EUR/USD with a 0.2 spread, you would be charged $10 in commission plus a spread cost of $2. If you then sold the 200,000 EUR/USD with the same 0.2 spread, you would be charged $10 in commission plus the spread cost of $2. If you only sold 50,000 of your position, you would be charged $2.50 in commission with a spread cost of 50 cents.

- DMA Direct Market Access Account

Created to cater high-volume traders that are looking for maximum control. The payment scheme is commissions only with no spreads. Forex.com recommends a minimum balance of of $25,000 for this account and the minimum trade amount is $100,000.

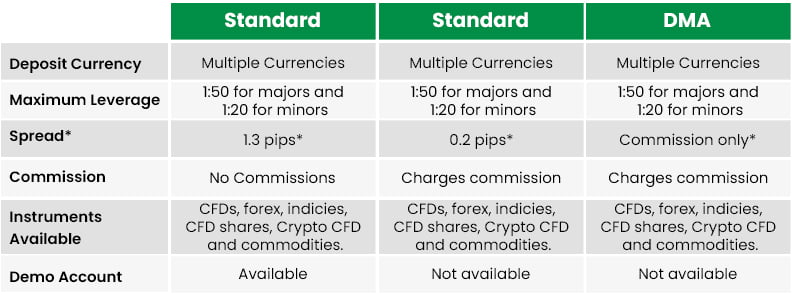

Account Comparison:

* Spreads can change due to market conditions. (This is an example for EURUSD)

The information in this table is correct at the time of publication and the company reserves the right to change at any time.

Inactivity Fees:

Forex.com charges a monthly inactivity fee of $15 for the inactive accounts of 12 months or more. Account balances starting from $10,000 base currency are exempt from inactivity fees.

Trading Platform:

Forex.com offers Metatrader 4 for standard accounts, and Forex.com web trading platform for commission and DMA accounts.

Customer Service:

Customer service is available 24/5. Traders can contact Forex.com customer service by phone, email, fax, or live chat.

The company FAQ on their website covers a wide range of questions.

Deposits & Withdrawals:

Forex.com has multiple methods for deposits and withdrawals. They accept

- Visa/Master Card

- Wire Transfer

Credibility:

Forex.com is considered safe since it has a long history. It is regulated & licensed across many regions.

Education:

Forex.com has an excellent education section. It offers the following:

- Courses for beginners, intermediate, and advanced traders.

- Demo account

- Platform tutorial videos

- Glossary

- Trading topics

- Educational articles