Smart Crowd is the Middle East’s first and only financially regulated digital real estate investment platform that gives investors the opportunity to access real estate through fractional ownership.

Smart Crowd allows users to purchase and invest in shares of rental properties with capital as low as AED 500.

How it works:

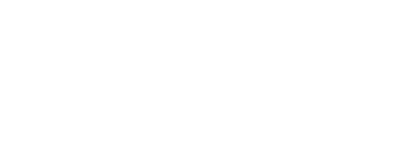

Property is listed on Smart Crowd platform with full analysis report and details of location, price, gross and net estimated rental yield and the expected return in case property sold after 5 years.

Here is an example of how properties are listed on the platform

- Investors register and choose the property they are willing to invest it

- If a property is not funded within the period of project listing, the investment will be refunded to the user digital wallet at no cost

- If a property was 100% funded by investors, Smart Crowd creates a Special Purpose Vehicle (SPV) for each property. They divide each SPV into one million shares and allocate investors shares proportionate to their investment. This means that investors own the SPV, which in turn owns the investment property.

- Investors start getting rental income

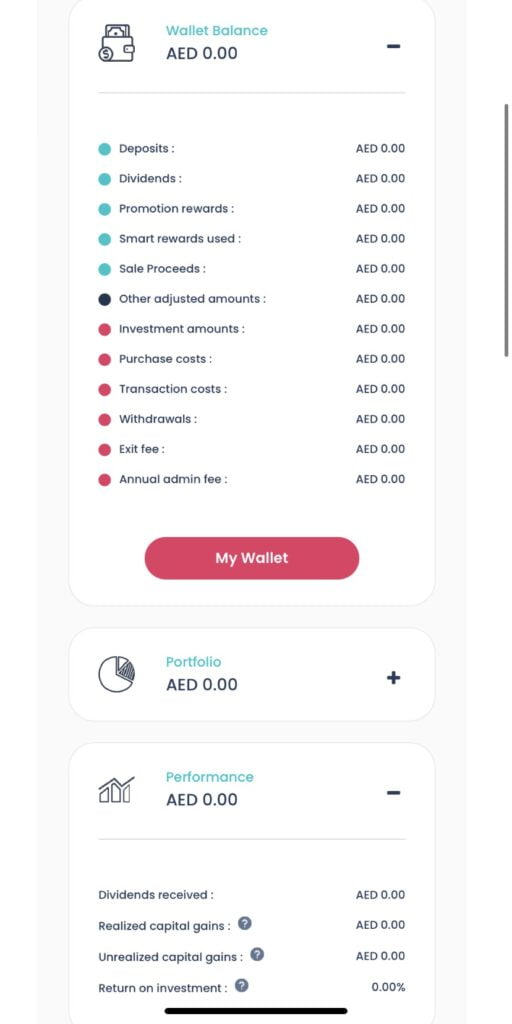

How Your Dashboard Will Look Like:

The dashboard will have all the details about your investments, and transactions occurred, such as deposits, fees, withdrawals and dividends.

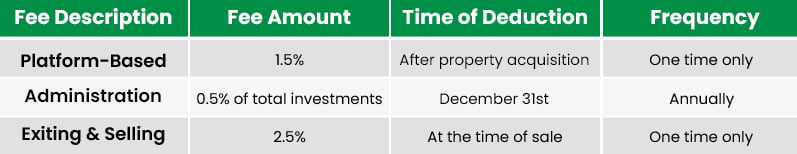

Fees:

Licensing:

Smart Crowd Limited (Smart Crowd) is registered in the Dubai Financial Centre DIFC – registered number 2704, and licensed by the Dubai Financial Services Authority (DFSA) – Reference no. F004285

Minimum & Maximum Investments:

The minimum amount to invest in each property is AED 500.

The maximum ownership limit is 24.99% of the value of each property for retail investors, and there is no limit for the professional investors.

Types of Investment Accounts:

There are two types of investment accounts in Smart Crowd:

- Professional Investors

If you a high net worth with a prior experience in similar financial markets, you’ll be considered as professional investor and there would be no limits for your investments.

- Retail Investors

If you don’t meet the criteria of the professional investor, you will be considered as a retail investor and your investment limits are set to $ 50,000 every year.

Retail investors are offered more protection than professional investors since they have less net worth, experience and understanding of such financial markets.

How ownership works:

Once the property is 100% funded by investors and acquired by Smartcrowd, the company will create a new separate entity. This new entity is called SPV (special purpose vehicles). They divide the SPV into one million shares and allocate investor shares proportionate to their investment. This means that investors own the SPV, which in turn owns the investment property.

Who Will Be the Owner of The Property on the Title Deed?:

Since it is not possible to list out dozens of names on a single title deed, the name issued on the title deed is the SPV (a separate new entity created to legally acquire the property) corresponding to the property. Ultimately, investor own direct shares in the SPV, which in turn is only responsible for holding the asset and paying out dividends to investors. To see your name as a shareholder, simply go on to the DIFC public register and type the name of the SPV that corresponds to your property. Typically the name of the SPV starts with the initials “SC” followed by a hyphen and a number.

Custodian Account:

Client Money is held by Smart Crowd in a segregated Client Account with Global Custodian Services (GCS). GCS is a UK company, authorized and regulated by the Financial Conduct Authority and holds Part IV Permissions under the FSMA 2000. Registration number 595875, as such GCS are fully regulated to hold client money for the purpose of investment. Whilst GCS is accountable to Smart Crowd for the safe keeping of its Client Money, GCS does not have a relationship with Smart Crowds clients directly. Therefore, Smart Crowd is wholly accountable for our investors “Client Money”. Smart Crowd has undertaken due diligence of GCS’s custodial systems and controls and deemed fit and proper to hold Client Money on Smart Crowds behalf.

Clients of SmartCrowd are subject to the protection conferred by the DFSA’s Client Money Provisions and therefore:

This Money will be held separate from Money belonging to SmartCrowd; and in the event of the Authorized Firm’s insolvency, winding up or other Distribution Event stipulated by the DFSA, the Client’s Money will be subject to the DFSA’s Client Money Distribution Rules. Interest on Client Money is not payable to you as a Client of Smart Crowd. As noted above Client Money will be held in the UK, outside the DIFC and the market practices, insolvency and legal regime applicable in that jurisdiction may differ from the regime applicable in the DIFC.

Key risks:

They following are a summary of the risks stated on the company website:

- Variable income: The rental income might be different than the estimate provided by the companywhen listing the property

- Ownership in non-tradable shares: Investors will not own the property; rather the investor will have an interest in another legal entity that owns the property. As the investor’s interest in that entity is not listed or traded, it is likely to be an ‘illiquid’ investment; that is, it may be difficult to sell the interest because of a lack of investors willing to buy such an interest. So the investor must be prepared to commit to investing for the full investment period.

- Liquidity: As real estate is an ‘illiquid asset’; that is, an asset that cannot always be easily sold, it may be difficult to sell the property at the end of the investment period, resulting in a delay in investors receiving their capital or in the property being sold at a loss.

- Once the secondary market is operational, you will be able to advertise your investment for sale to other Smart Crowd users at any point. However, there may not be anyone willing to buy your investment at a price that you deem reasonable (or buy it at all). In that event you will be required to wait until the end of the investment term for an exit. Even at this point, the timing and ability to exit will depend on completion of a transaction to sell the underlying property. This transaction could take several months.

Liquidity:

At the moment there is no secondary market the investors can sell their shares through. The investment period is 5 years. At the end of the investment term, all investors have the opportunity to vote to sell their holdings at market value. The property will be evaluated by an independent Real Estate Regulation Authority (RERA) approved valuator. Alternatively, investors can call for a vote amongst themselves at any point in time.

✅ Special Offer: