How to Buy US Stocks from UAE (2025 update)

This article should not be considered as an investment advice. Our content is purely the opinions of the content creator. Thefinancedean.com is not responsible for any investment or trading decisions that occur due to the content available on this website.

Some of the links on our pages are affiliate links, meaning that at no additional cost for you, we might get a commission if you click and invest. This commission helps us to cover the website cost and to keep providing you with the information that might be useful to you.

Investing in US stocks from the UAE might seem complicated, but it’s actually pretty straightforward. Whether you want to buy shares in companies like Apple or Amazon, or just explore the US market, this guide will help you get started.

We’ll break down the process step by step, explain how to choose the right broker, and share some tips to make investing easier. Let’s take it one step at a time.

In summary, to get US stock market access, you need to do the following steps:

2. Verify your account (Passport/ID, proof of address)

3. Fund your account (Credit/Debit card, Bank transfer)

4. Choose US stocks you want to invest, and buy

In this article, we will show you in details how to open a stock brokerage account in Dubai, UAE and what is the best stock broker in the UAE

*Note: This list doesn’t necessarily cover all brokers in the market.

| Broker Name | Fees | Features | Pros | Cons |

|---|---|---|---|---|

| Sarwa | 0% commission on US stocks | User-friendly app, automated investing | Low fees, beginner-friendly | Limited advanced trading tools |

| eToro | No commission on US stocks | Social trading, copy trading | Beginner-friendly, no deposit fees | Currency conversion fees on non-USD deposits |

| Saxo Bank | $1 per trade | the widest range of financial instruments | Advanced tools, high security | High minimum deposit ($10,000) |

| Baraka | 0% commission on US stocks | Mobile app, curated stock lists | No minimum deposit, beginner-focused | Limited features compared to larger brokers |

Read More: How to Invest in UAE: Investing Guide

Brokers differ in their offerings and fees; each has its own advantages and disadvantages. You need to understand what they offer to decide which one suits you the best.

Here are some of the major differences between the brokers:

• Commissions:

There are some brokers that charge trade commissions each time you want to buy or sell a stock. While some other brokers offer buying/selling the stocks with zero commission and without any fee.

This is a crucial factor to consider when selecting a broker.

To understand the impact of the trading fees, suppose that you are trading through a broker who charge a trade fee of $25 for buying and selling. If you want to buy a stock with $1,000, then you need to pay $50 as a transaction fees ($25 for buying the stock and $25 when selling the stock in the future), it means you are paying 5% ($50/$1000).

If the average annual profit to from the stock market is 8%, you will be getting only 3% since you have already been charged 5%.

• Minimum Deposits:

Some brokers don’t require any minimum deposits to start your account, while others set a minimum amount to be deposited in order to activate your account. For example, Saxo Bank offers access to numerous financial products but requires a $10,000 minimum deposit. So if you are not willing to invest that much, you need to search for some other brokers that don’t require a minimum deposit

• Account Opening Process:

With some brokers, opening and verifying an account is quick and straightforward. Others may require additional documents, such as proof of income or bank statements, and might even need you to visit their office in person.

Note: A more complex process doesn’t necessarily mean the broker is inferior. Some investors prefer these brokers, valuing the added security of stringent selection criteria.

Required documents may vary between brokers, but commonly include::

• Passport

• National ID

• Proof of address (can be a utility bill, bank statement with the address shown on it, tenancy contract).

Each listed broker has its own strengths and weaknesses. Also, there are many factors to consider before deciding on the broker, such as experience level, the platform’s complexity, frequency of trades you place.

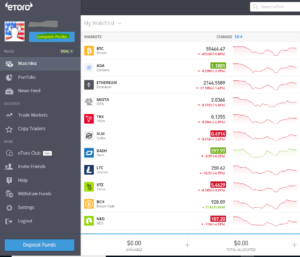

After carefully trying multiple brokers, we can recommend eToro for stock investing.

eToro offers a zero-commissions stocks (disclaimer: Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

The platform is straightforward and user-friendly, especially if you are a beginner.

Whether you are starting your investing journey or you are an experienced investor, eToro is an exciting platform and available in more than 140 countries all over the world.

Also, you can benefit from the social trading eToro offers. With social trading, you can check other people portfolios, what are they investing in, profit/losses percentage they are making, and you can choose to copy one or more, so whenever they place a trade, you will make the same profit/loss they are making based on the amount you copied them with.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Disclaimer: (Your capital is at risk.)

Click here to visit eToro website, choose a username, email, password, read the terms & conditions, accept them if you wish and click Join now

After pressing “Join now”, an email will be sent to your inbox for confirmation, login and verify

Once you verify your email, you will be able to login to your eToro platform. But at this point, your account is still not verified and there would be limitations on depositing and trading until you complete your profile.

To enjoy a faster depositing and withdrawal, and trading with no limitations, you need to get your account verified.

Follow the steps of verifying the account and provide the required information that includes your personal details and proof of your identity and residential address.

Note: To verify your account, you need your passport and a valid utility bill to prove your identity and physical address.

After finishing the verification process, it will take eToro a couple of days to check the information and get your account fully verified.

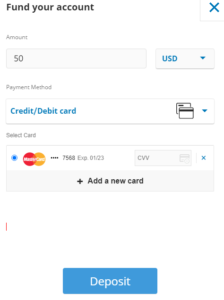

Before you can start trading on the eToro platform, you need to fund your account. You will be directed to the safe and secure eToro cashier page where you can make your deposit.

To fund your account, simply login using the username and password you created in Step 2 above, then click on the ‘Login’ button to proceed.

eToro accepts different types of payment methods including wire transfer, PayPal, Skrill, Neteller, Visa, MasterCard.

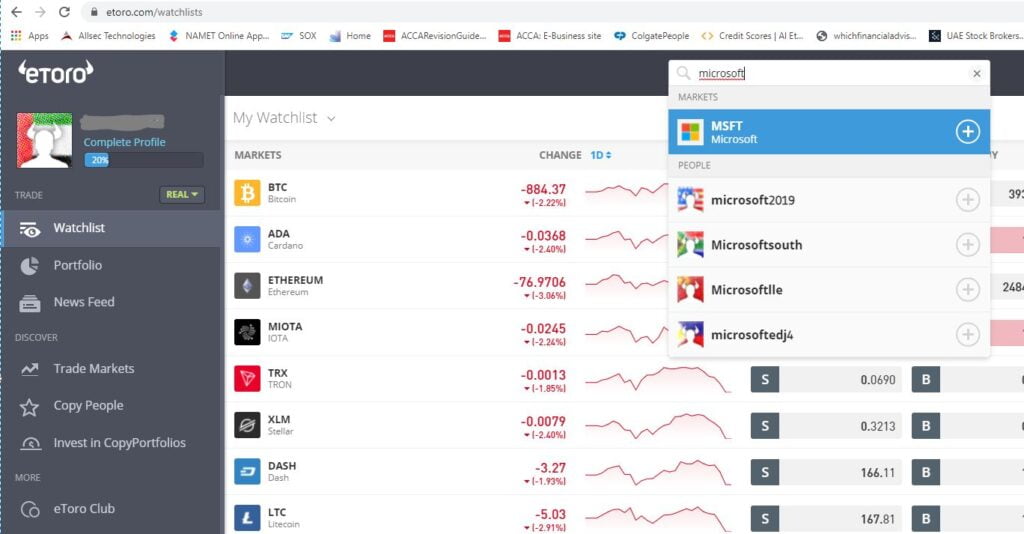

Now you have your account verified and funded. It’s time to start investing.

To search for the stock you are willing to invest in, go to the search bar and type the stock name

Choose that stock and then click “Trade”, choose the amount you are willing to invest, and there you go!

It’s important to remember that with eToro you can Fractional Share, meaning that if for example a stock price is $300, you don’t have to pay the full amount to buy it. You can buy a fraction and you may choose to invest only $100, so you will buy 0.33 shares.

Another way of investing in the US stock market from the UAE is to use the help of a financial advisor. The benefit of using a financial advisor help is that they can help you to create a well-balanced and diversified portfolio based on your goal and risk apetite.

You can use the help of financial advisors if one or more of the following applies to you:

Even though charges vary from an advisor to another, however, the average charge can be somewhere around 0.1% – 0.2% monthly on your assets. In other words, if you invested $5,000, the monthly charge will be around $5 to $10.

There are multiple brokers that enable you to invest in US stocks while living in the UAE, and each of them has pros and cons and some unique features that give them a competitive advantage over the other brokers, so it’s highly recommended to do your research and choose the broker who suits you most.

Disclaimer:

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro

That’s all what I wanted to know! Thanks a lot for this article