Top Takeaways for 2022:

Here are our top findings on Swissquote:

- Swissquote Group is a leading provider of online financial and trading services

- Swissquote has an office in Dubai Downtown

- Swissquote is one of the best and safest broker for trading.

- Swissquote (SQN) was listed on the SIX Swiss Exchange, a significant accomplishment for any company!

- Swissquote offers wide range of financial instruments for trading such as Stocks, ETFs, Forex, Commodities, Indices, and Cryptocurrencies.

✅ Special Offer If you Register Through Us:

Deposit $1000 and get $100 deposited to your account by the broker

Swissquote is a Swiss investment bank established in 1996.

Listed on the SIX Swiss Exchange (symbol: SQN) since May 29, 2000, the Swissquote Group has its headquarters in Gland (VD) and offices in Zürich, Bern, London, Luxembourg, Malta, Dubai, Singapore and Hong Kong.

Swissquote MEA Ltd. is a subsidiary of Swissquote Bank SA based in Dubai, UAE and has office in the DIFC.

Swissquote Group is a leading provider of online financial and trading services. Offering many financial instruments such as forex and CFDs, they are one of the most diverse brokers in the industry regarding their product offerings. However, when it comes to robo-advisory, there is no competition: Swissquote Group has been at the forefront of this new and exciting development in the world of investing for years now.

Swissquote Overview:

Swissquote Group is a leading provider of online financial and trading services. Offering many financial instruments such as forex and CFDs, they are one of the most diverse brokers in the industry regarding their product offerings. However, when it comes to robo-advisory, there is no competition: Swissquote Group has been at the forefront of this new and exciting development in the world of investing for years now.

Swissquote Group is known for its wide variety of investment opportunities. A great example of this would be forex trading, which has grown exponentially in recent years as investors look for more flexible ways to make money. Trading the currency market with Swissquote Group’s award-winning platform gives clients access to both spot and forward contracts on over 50 major currencies worldwide.

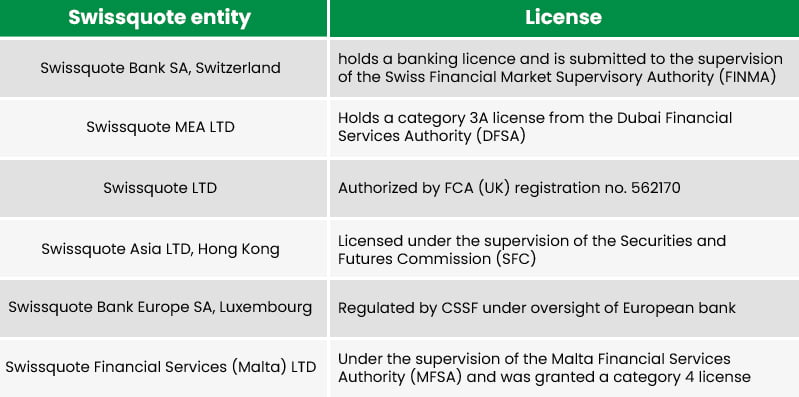

Regulations:

Seeing that the company works in several fields, it is regulated by several bodies in Switzerland and several countries, These include:

- Dubai Financial Services Authority (DFSA)

- Securities and Futures Commission (SFC)

- Malta Financial Services Authority (MFSA)

- Financial Services Authority in Singapore (Monetary Authority of Singapore, MAS)

- Commission de Surveillance du Secteur Financie (CSSF)

- Financial Conduct Authority (FCA)

As such, you can be sure that your funds are safe and secure with Swissquote Group. Some of these regulations mean that client and business funds do not mix and protect customer funds from business obligations.

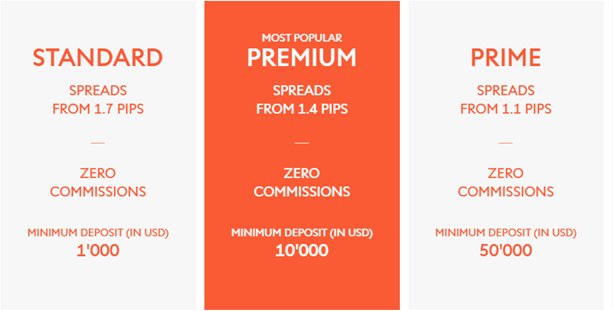

Account Types:

During the process of signing up, clients will be asked to choose their preferred account type. This is usually dependent on how much you are willing to work with and your level of skill.

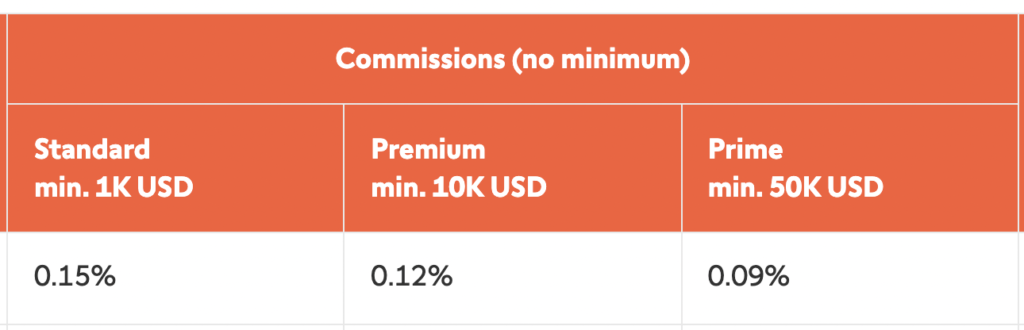

Standard account: this is the most basic account here. The forex spreads from 1.7pips with no commissions. There is a small 0.15% commission on stocks with no minimum spread and a USD 1,000 minimum deposit.

Premium Account: this is the most popular choice on the platform offering similar terms as the standard account for forex trading but with better commissions in stocks at 0.12% also without a minimum. The minimum deposit for this account is USD 10,000.

Prime Account: this account has very favorable terms for both forex and stocks. Forex enjoys spreads from 1.1 pips without commissions, and stocks only attract 0.09% but also have a minimum deposit of USD 50,000.

Professional account: this account is for experts and professionals working with large sums of money in either forex, stocks, or both. As such, they enjoy custom spreads on forex and bespoke prices on stocks!

Minimum Deposit:

Swissquote UAE requires a minimum deposit of $1,000 for the standard account, $10,000 for Premium account and $50,000 for Prime account.

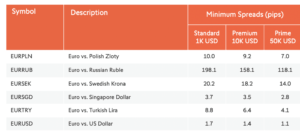

Spread, Leverage & Fees::

Spreads are the difference between the bid and ask price for a currency pair or financial instrument. Swissquote provides competitive, variable spreads adapted to your initial deposit. They are measured in pips.

For Forex, Swissquote applies all-in spreads – it does not charge any additional fees or commissions on transactions. All costs are included in the spreads as follows:

Standard Account – 1.7 pips

Premium Account – 1.4 pips

Prime Account – 1.1 pips

As for the Stock CFDs, the commissions are as follows:

Standard Account – 0.15% commission

Premium Account – 0.12% commission

Prime Account – 0.09% commission

Trading Platform:

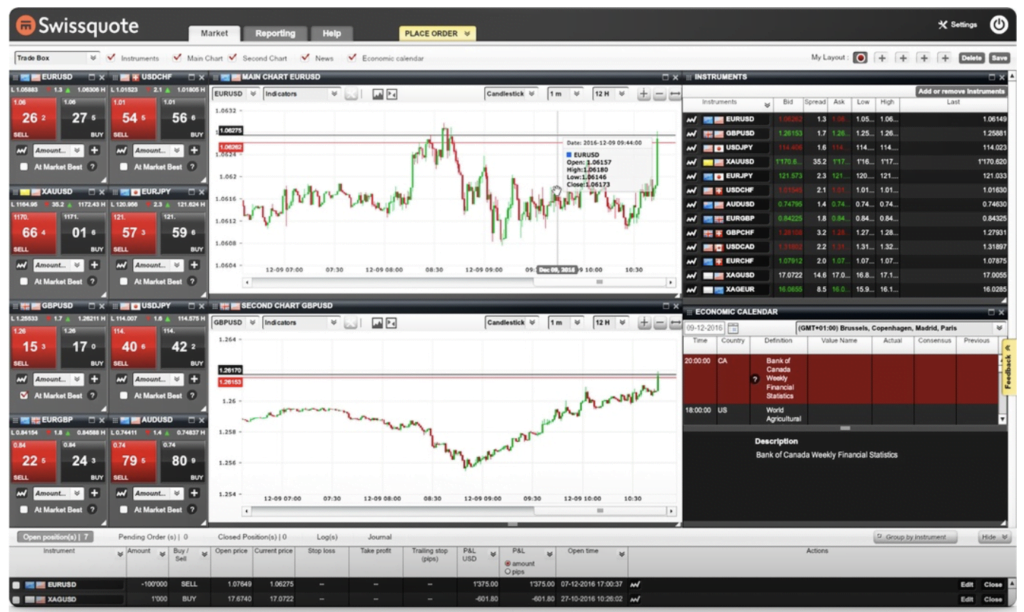

You can operate on Swissquote’s trading platforms via desktop, mobile, or tablet.

The web trader is an easy-to-use platform with various tools included for your convenience, such as real-time quotes, charts, and news feed. It also offers the standard order types like market, limit, etc, which are all customizable depending on your needs!

Swissquote provides several trading platforms; users have the option to choose MT4 or MT5 or Advanced Trader

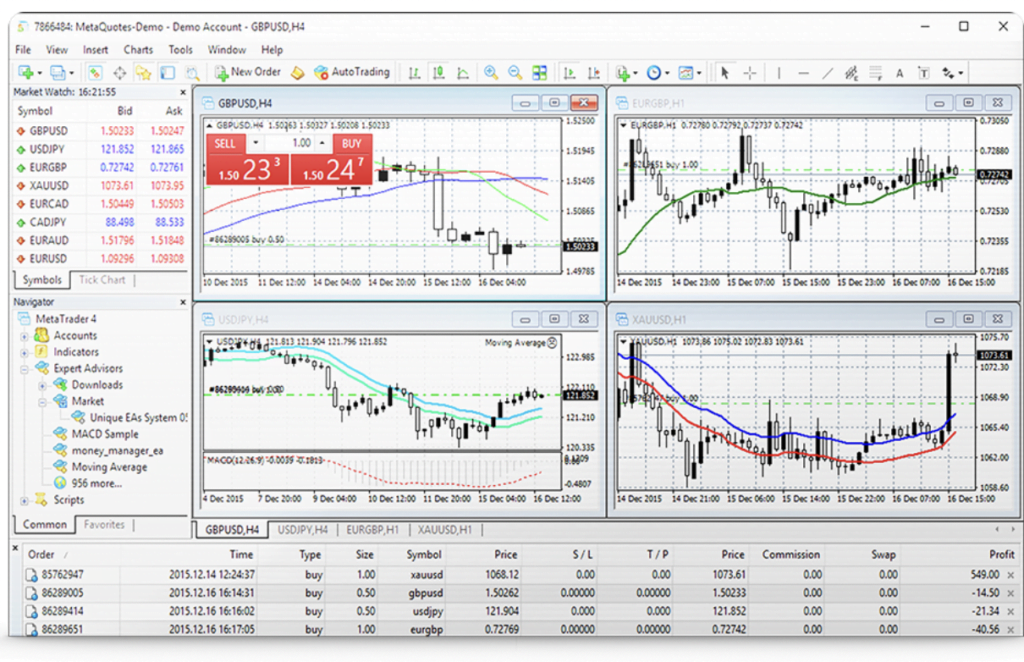

MetaTrader 4:

Swissquote’s MetaTrader platform is available in desktop, mobile, and tablet versions. The webtrader can be used on all platforms through the charting package does vary slightly. On the MT platform, you are given access to over 45 technical indicators and a variety of tools that allow for an even more advanced trading experience! This includes things like automated strategies, expert advisors (known commonly as EAs), market analysis & news feed, which do make this one of Swissquotes’ best assets, especially when it comes to day traders who require these functions at their disposal.

Swissquote offers many research tools via MT, including an economic calendar, news feed, and technical analysis but does lack some of the advanced features you would find on other brokers such as live chat or personal phone support, which can be pretty useful when it comes to quick answers rather than lengthy email correspondences that are often encountered here.

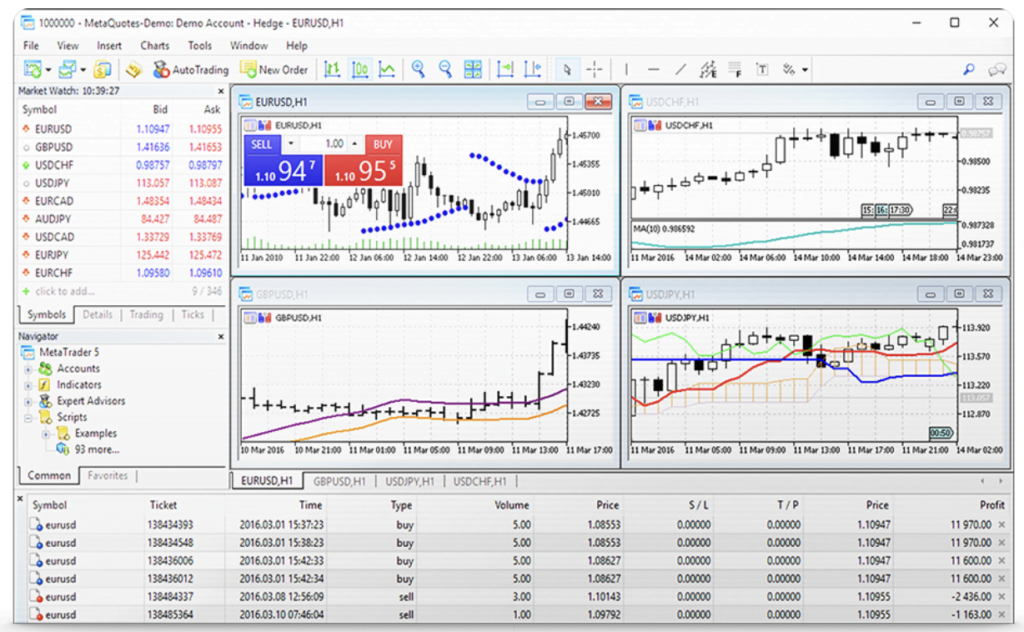

MetaTrader 5:

Swissquotes’ MT platform is one of the most popular among traders & with good reason – it offers a wide range of tools for both novice and advanced users, has access to over 45 technical indicators, and allows you to backtest strategies using historical market data easily. The charting package included here also allows for some incredibly detailed analysis, which should satisfy all types of traders!

Swissquote does add an additional commission when trading on its MT platforms, so before signing up, be sure to check whether this will affect your trades or not, especially if you are looking at a day or intraday trading options where commissions can quickly rack up, making them unprofitable. There currently aren’t any negative aspects I could point out about Swissquote’s MT platform other than the fact that it has no social features included at this time – hopefully, they will be implemented in future updates!

Advanced Trader:

Swissquote’s advanced trader option is for more experienced traders that are interested in using leverage. This allows you to trade with an increased capital compared to your initial deposit, increasing the risk and increasing potential profits. This service has a minimum account balance of $25k, which is on par with most brokers offering margin trading.

Swissquote offers both long & short-term positions, including OTC spot forex (delivered via its partner company GKFX) as well as stocks & indices! The maximum leverage provided here is 50X, meaning if you open a position worth 100 units, then only $50 will be deducted from your account upon opening – returns can vary significantly, though, depending on what types of assets you trade.

Customer Service:

Swissquote’s customer support team is not available 24/7. Still, you can reach them via phone, email, or live chat, and they also offer a very helpful FAQ section that should answer the majority of questions you might have!

Swissquote does not currently provide any social media support such as Twitter though this is something we believe will be added in the future.

Deposits & Withdrawals:

Swissquote has multiple methods for deposits and withdrawals with several account base currencies. They accept:

- Visa/Master Card

- Bank Transfer

Safety:

Swissquote is considered very safe because it has a banking license and listed on the Swiss Stock Exchange.

It also has different licenses for its legal entities across the regions they work in.

Education and Market Analysis:

Swissquote offers a range of educational content for new traders to help get the most out of MT and their other trading platforms.

Also, they offers good education tools to enhance users trading experience such as:

- Webinars and Seminars

- Tutorial videos to help users be familiar with the platform

- Forex learning center with videos and e-books

- Technical analysis and Fundamental analysis