Top Takeaways for 2022:

Here are our top findings on ICM Capital:

- Global broker with multiple regulations

- ICM Capital has an office in Dubai Downtown

- Highest level of safety & protection

- Tight variable spreads

- Extensive free educational resources

- ICM Capital offers wide range of financial instruments for trading such as Stocks, ETFs, Forex, Commodities, Indices, and Cryptocurrencies.

✅ Special Offer If you Register Through Us:

Start trading and get $200 deposited to your account by the broker

ICM Capital Overview:

ICM Capital is a well-known international online Forex and CFD trading firm offering traders an access to a wide range of trading products including foreign exchange, commodities, futures, stocks and indices.

ICM Capital was Founded in 2009, the company headquarter is located in the UK with offices in China, Mauritius, UAE and Singapore, ICM Capital uses MetaTrader 4 trading platform.

Regulations:

ICM Capital is regulated by the Financial Conduct Authority (FCA registration number 520965) in the UK, which means it is a secure firm.

In order to get a license from this authority, UK-based brokers have to adhere to strict rules, such as keeping clients’ money in a separate custodian account and reports to FCA regularly.

Moreover, companies regulated by the FCA have to keep at least $730,000 net in tangible assets as a proof that they are stable and legitimate.

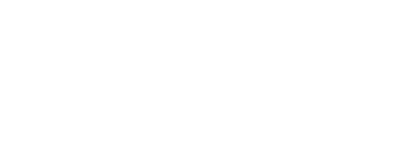

Account Types:

ICM Capital offers two account types, ICM Zero and ICM Direct, depending on client’s country of residence and the regulations.

ICM Zero

ICM Zero account has zero spread for trades, but they charge a commission instead which is $7/Round Lot.

ICM Direct

ICM Direct account has no such commission but it has spreads. The spread is 1.3 pips for EURUSD

Both trading accounts are the same in terms of supported instruments and leverages available.

Below you will see more details about the difference between the two accounts

Minimum Deposit:

The minimum deposit amount to start trading is 100$. It’s very convenient especially for the first time traders who are not willing to put a lot of money as a start.

Leverage, Spread & Fees:

Spreads are the difference between the bid and ask price for a currency pair or financial instrument. ICM Capital provides competitive, variable spreads adapted to your initial deposit. They are measured in pips.

For Forex, ICM Capital applies all-in spreads for ICM Direct, while it offers zero spreads for ICM Zero, but they charge a trade commission instead.

*Spreads can change due to market conditions. (This is an example for EURUSD)

Trading Platforms:

ICM Capital provides three trading platforms, MetaTrader4 MT4, Meta Trader 5 MT5 and Web Trader cTrader Platform. Traders can choose from sub-platforms like MT4 for Mac, desktop, Android, and iPad/iPhone. They can also choose a web-based platform.

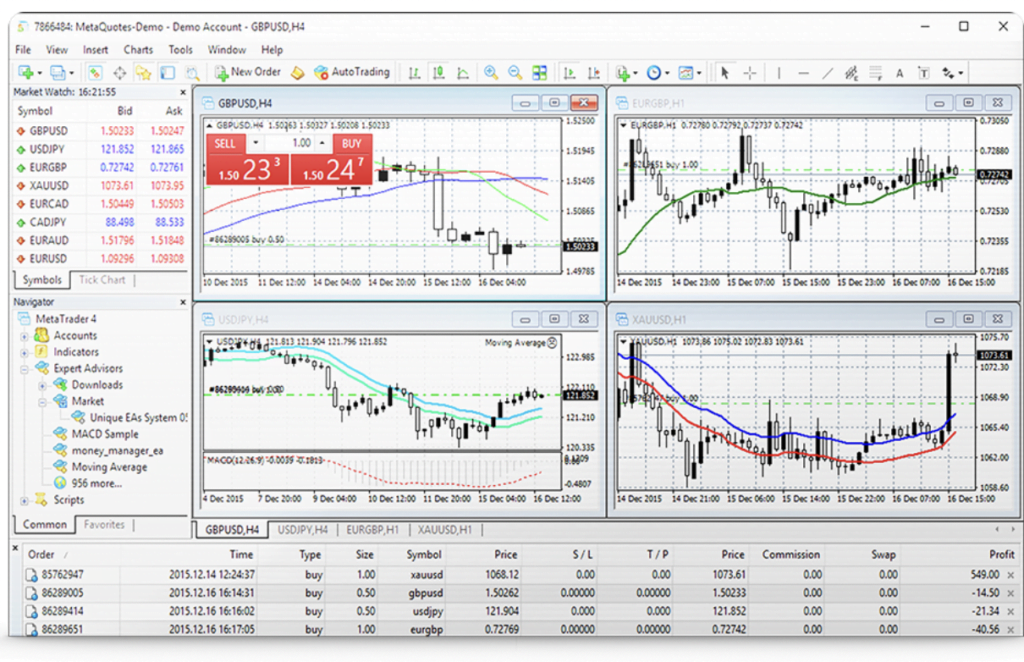

MetaTrader 4:

ICM Capital’s MetaTrader 4 platform is available in desktop, mobile, and tablet versions. The webtrader can be used on all platforms through the charting package does vary slightly. On the MT4 platform, you are given access to over 45 technical indicators and a variety of tools that allow for an even more advanced trading experience! This includes things like automated strategies, expert advisors (known commonly as EAs), market analysis & news feed.

ICM Capital offers many research tools via MT, including an economic calendar, news feed, and technical analysis but does lack some of the advanced features you would find on other brokers such as live chat or personal phone support, which can be pretty useful when it comes to quick answers rather than lengthy email correspondences that are often encountered here.

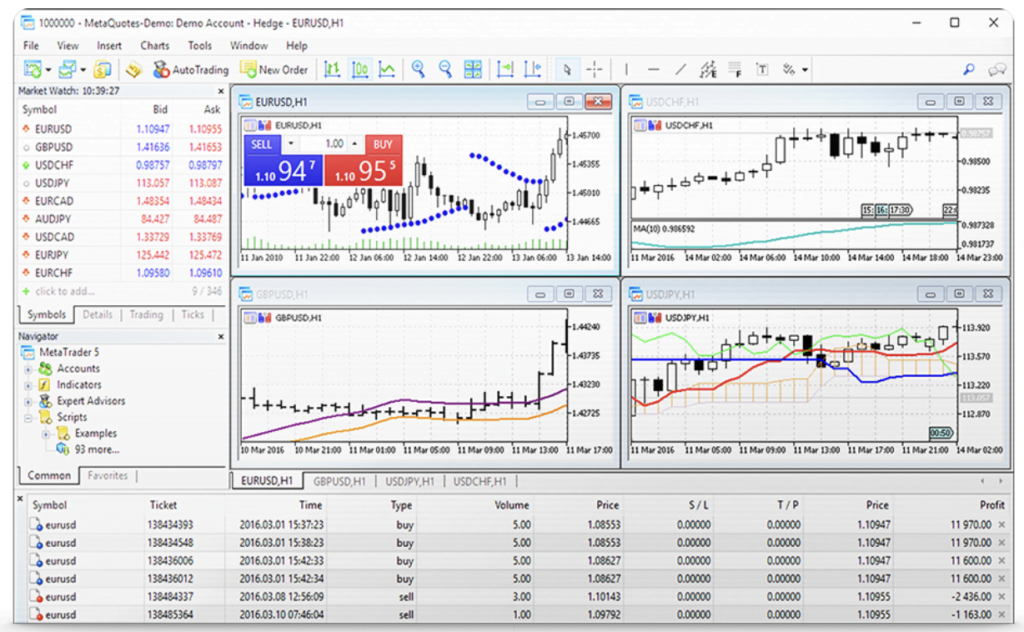

MetaTrader 5:

ICM Capital’s MT platform is one of the most popular among traders & with good reason – it offers a wide range of tools for both novice and advanced users, has access to over 45 technical indicators, and allows you to backtest strategies using historical market data easily. The charting package included here also allows for some incredibly detailed analysis, which should satisfy all types of traders!

cTrader:

cTrader is an independent trading platform developed for trading foreign exchange and products based on futures contracts.

The trading platform can be downloaded securely via our website direct to your PC. Through cTrader you will obtain access to fast, tight prices when trading forex, as well as products based on futures contracts such as gold, silver, oil, commodities and indices.

The cTrader platform has diverse technical analysis and the ability to run cTrader forex robots, while also ensuring the ongoing protection of your data at all times.

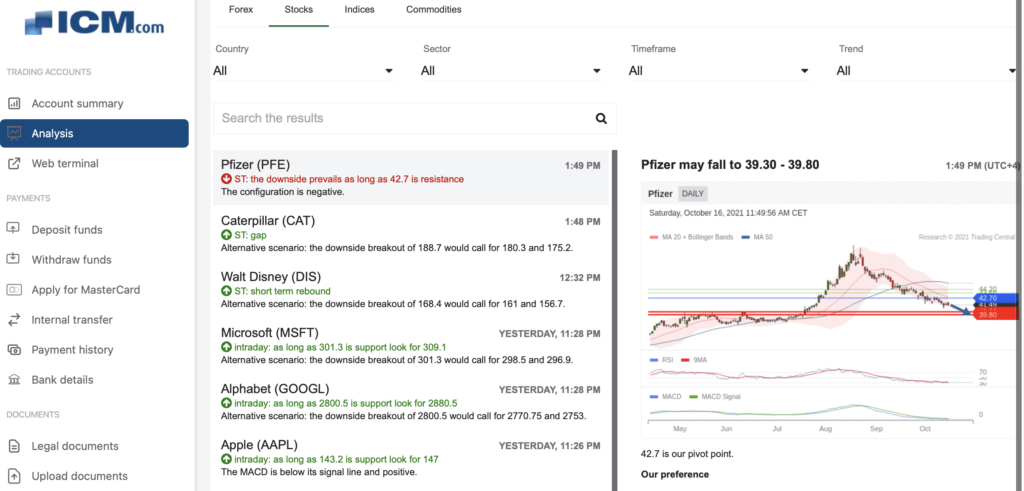

How Your Dashboard Will Look Like:

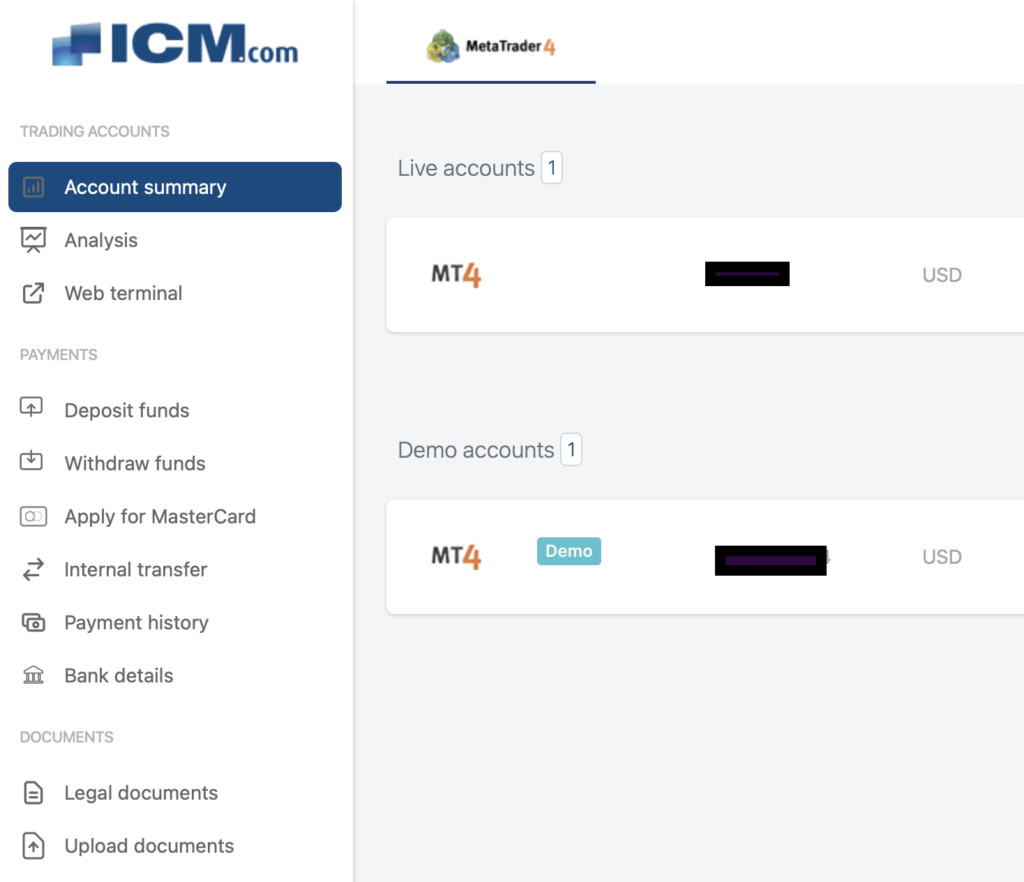

When you login to ICM Capital, your Dashboard will have 3 main sections:

- Trading Account Summary, which will have you account details, some analysis to help you with your trades, and a link to MT5.

- Payments Section, which will have everything related to deposits, withdrawals and you can request for a Master Card from that section as well

- Documents Section, where you can upload your required documents

Customer Service:

ICM Capital has excellent multilingual customer service. A “request a call back” is also available on the company website.

Customer service is available 24/5

Deposits & Withdrawals:

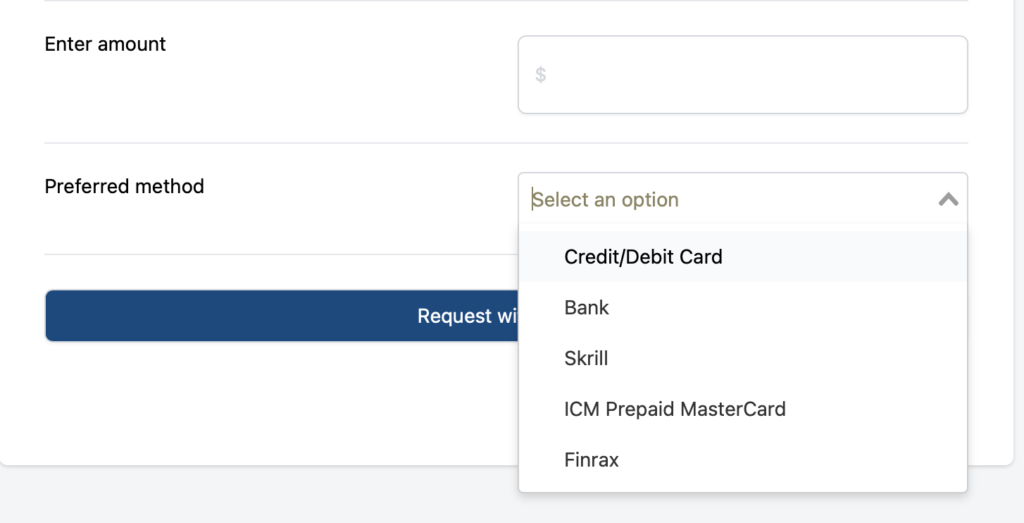

ICM Capital has multiple methods for deposits and withdrawals. They accept:

- Visa/Master Card

- Skrill

- Neteller

- Bank Transfer

Safety:

ICM Capital is considered safe since it is authorized and regulated by the Financial Conduct Authority (FCA) which regulates the financial services industry in the United Kingdom, protect consumers, ensure the industry remains stable and promotes healthy competition between financial services providers.

Education:

ICM capital has a good education center designed to cater beginner and advanced traders and offers the following:

- Analysis

- Trading Examples

- Trading Glossary