investing in etfs in dubai (2025 Guide)

This information is neither a financial advice nor a recommendation. Do your own research or seek the help of your financial advisor before taking decisions.

Some of the links below are affiliate links, meaning, at no additional cost for you, we might get a commission if you click and invest. This commission helps us to cover the website cost and to keep providing you with the information that might be useful to you.

ETFs has become one of the most popular investment options for many people since it provides portfolio diversity, minimize the risk of putting the money in an individual stock, and provide investors with the flexibility of choosing the “theme” they are willing to invest in.

In this article, we will explain about ETFs and how to invest in ETFs in Dubai.

An exchange-traded fund (ETF) is a financial instrument that holds a basket of different securities like bonds, stocks, and commodities.

Think about it as a group of stocks, wrapped together and sold as one package. This package is the ETF, and the performance of the underlying stocks will determine that ETF’s performance.

ETFs can replicate a market sector such as real estate, reflect a financial instrument or commodity’s performance, such as bonds or gold, or replicate a specific index like the S&P 500.

For Example, if you’re willing to invest in the technology sector, but you’re not sure which stocks to pick, or you want to diversify your investment, you can buy an ETF that tracks the technology sector’s performance, such as SOXX ETF

Those types of ETFs hold stocks of multiple technology companies. By investing in one, you’ll get the diversification you seek as if you are buying all the stocks under that particular ETF.

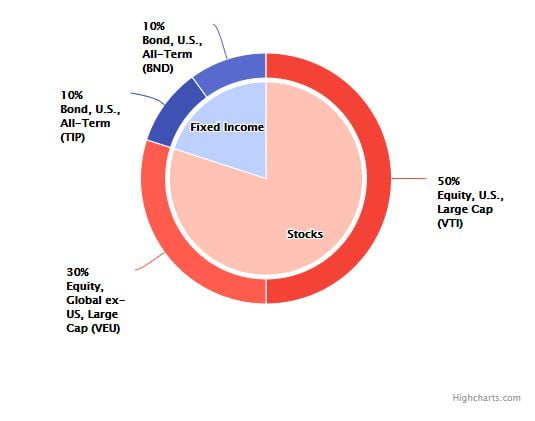

• 80% Stocks

• 20% Bonds

Can be replicated with 4 ETFs:

50% Vanguard Total Stock Market (VTI)

30% Vanguard FTSE All-World Ex-US (VEU)

10% Ishares TIPs Bonds (TIP)

10% Vanguard Total Bond Market (BND)

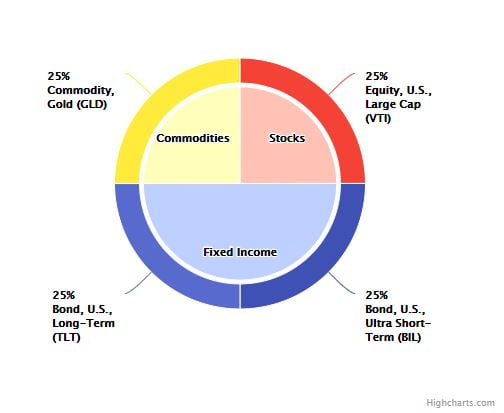

• 25% Stocks

• 50% Bonds

• 25% Gold

Can be replicated with 4 ETFs:

50% IShare 20+ Years Treasury Bond (TLT)

25% Vanguard Total Stock Market (VTI)

25% SPDR Gold Trust (GLD)

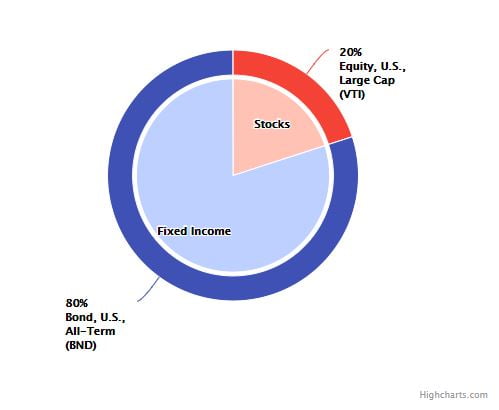

• 80% Bonds

• 20% Stocks

Can be replicated with 2 ETFs:

80% Vanguard Total Bond Market (BND)

20% Vanguard Total Stock Market (VTI)

If you want us to help you to build your own ETF Portfolio (Completely Free), drop us an email on

info@thefinancedean.com

If you are willing to invest in ETFs from UAE, you can either do it yourself through brokers, or through an expert financial advisor where you both discuss the strategy and theme you are willing to invest in.

1. Invest in ETFs by your own:

To buy ETFs in UAE by yourself, you must have an account with a brokerage firm registered with the exchange where you want to trade ETFs.

One of the most famous brokers to invest in stocks and ETFs in Dubai are:

Disclaimer: Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

2. Invest in ETF through a Financial Advisor

If you don’t know how to do it yourself, or you don’t have the time to research and monitor the news and markets, you can use the help of a financial advisor. It’s their job to be always updated with market trends and potential opportunities. You will explain to them your goals and risk appetite, and they will create an ETF portfolio for you and they’ll review it periodically with you.

You can do your own research to find the best financial advisor in UAE. Also, you can check our recommended list. We chose this list carefully based on popularity, good reviews, the strength of the companies they work for, and the range of products and solutions they provide.

Buying ETFs is a cost-effective method of investing in different stocks or underlying securities.

Suppose you want to invest in the S&P 500 stocks and replicate the S&P 500 index returns; you will need a large sum of money to allocate your cash to purchase hundreds of different stock types. In contrast, by investing in one of the ETFs that track the S&P 500, such as SPDR S&P 500 (SPY) or Vanguard 500 Index Fund ETF (VOO), you can replicate the performance of that index.

Many mutual funds charge you a sales load each time you invest in them. However, when you buy ETFs, no sales load is charged, making it a cost-effective option compared to mutual funds.

However, there would still be a cost to trade ETFs, and they are not completely free. This cost differs from one ETF to another, and you can review them on the ETF factsheet.

Not only are ETFs cost-effective, but they are also easy to trade. You can buy and sell them as frequently as you like, just like stocks.

You can also perform all sorts of technical and fundamental analysis on the ETFs the same way you do on stocks.

One of the best advantages of ETFs is the diversity that you get when investing in them.

By investing in one ETF, you can get exposure to commodities, indices, currencies, foreign markets, foreign companies, etc.

Such diversity reduces the portfolio risk and makes it less volatile.

Although ETFs provide numerous advantages, investors should be aware of the following dangers when using them:

ETFs can experience rapid price fluctuations, leading to volatility in your investment value.

It may be difficult for some ETFs, particularly those with lower trading volumes, to buy or sell at the appropriate prices rapidly.

Broad-market ETFs might include underperforming assets, potentially leading to diluted returns.

Your capital is at risk

ETFs have been growing in popularity, with a growing number of investors adding them to their portfolios because of the many benefits they offer. Many types of ETFs are available to investors, which investors can buy to get exposure to different assets cost-effectively.

Thanks for all the detailed information. I have question. What do you think is it better to invest on EFT with a broker such as Interactive Broker or with Sarwa Trade, being in the UAE?

Hi Kevin, I sent you an email with the answer of your question. Hope it’ll help

Hello, would you please send me the same email, i have the same inquirey.

thank you.

Hi Magdy, Sent to your email. Hope it helps

Hi, Could you please send this to me as well?

Hi Humayun, you’ll receive an email shortly. Thanks for reaching out

Send me also bro

Sent to your inbox Mohamed

Hello, please send me the same email

Hai Sain, sent to your inbox

Thanks for the detailed articles, was wondering if you could send me a quick guide on email on building effective ETFs portfolio. Thanks.

Hello Mina, we don’t really provide any financial advices. However, I will send you now some useful websites that can help you to build an ETF portfolio. Hope it’ll help!

Can you help sharing the same information with me

Thanks for the information. Very helpful!

Can you please also send me the email with suggestions for the brokers to select in UAE and as well tips on building EFT portfolio

Appreciate your help

Hi Sergio, sent to your email

hi could you please forward the mail to me as well

Thanks for the very valuable info provided here.

I would appreciate the same email you sent to Kelvin

Hi Ken, sent to your email. Thanks for your kind comment

Could u help me with the best website to build my ETF portfolio?

Hi Allen, sent to your email. Hope it’ll help

Sir, thanks for your detailed info.

Plz suggest some useful websites to select ETF.

Best regards,

Hi James, thanks for your comment. Please send an email to info@thefinancedean.com and we’ll help you out.

Looking for some tips on investing in ETFs as I’m based in Dubai please.

Hi Greg, will send to your email. Thanks

Thank you for the article. I am thinking where to start investing in ETF. Is there any other brokers or professionals to give suggestions?