How to Build a Stock Portfolio in UAE

Being in the UAE gives you access to multiple investing options. There are several ways to grow your hardly-earned savings.

one of the most common ways of investing from UAE is the US stock market. There are many trading platforms and international stock brokers that enable you to invest in US stocks from UAE.

But before you start, you probably need to read this article where we try to answer the question of how to build a stock portfolio in UAE that can minimize your risks.

Investing in stock market is considered one of the most popular investment vehicles. The average return of the S&P 500 in the past 30 years was around 12%.

Ideally, your money needs to be invested because keeping them in a saving account will give a maximum interest of 1%, not even protecting you from inflation.

You have the options either to buy specific stocks of companies of your choice or to invest in index funds that track a particular market or industry.

However, if you decided to choose the stocks by yourself, make sure you do your analysis and research about the company you are investing in.

Read more: how to evaluate a stock before buying.

If you don’t have the knowledge or time to do that, it’s highly recommended to invest in index funds that already hold the best performers of the market or industry they track.

Read more: How to invest in Index Funds in Dubai.

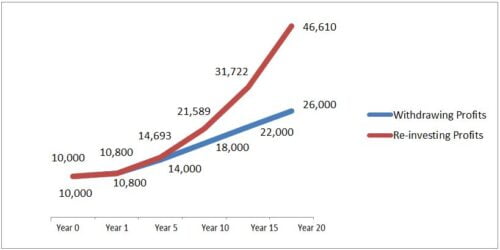

Wealth comes from accumulation and re-investing the returns, so compounding works miracles to your money.

In the following example, you will see the difference between withdrawing your returns versus re-investing them.

If you invested $10,000 in an 8% returns for 20 years, considering that you are withdrawing the returns and not investing them back, will give you a total return of $16,000, and your total amount would be $26,000 (your capital $10,000 plus the ten years returns of $16,000)

If you invest the same $10,000 with the same returns of 8% for ten years, but each time you get the annual returns, you invest back; surprisingly, after ten years, you will end up with $46,610.

This is the magic of compounding. You added nothing from your pocket; you were only re-investing the profits and watching your money grow.

Even though the stock market is one of the most rewarding and profitable investments, it is still volatile and holds many risks; therefore, you need to implement some strategies to protect your money and maximize the returns even in the declining markets.

Below, you can find the main tips you need to consider when investing in stocks:

• Long-term Investing:

Investing in stocks is a long term game, and to master it, you need to shift from the TRADER to INVESTOR mindset. Turning to an investor mindset means you will stop the emotional buy and panic sell. You will stop checking your account balance daily. You won’t be bothered with the temporary market conditions, and you will only be focused on the big picture.

Historically the stock market has rewarded the long-term investors who kept invested for 10, 15, and 20 years and even more.

If you invest this way, you wouldn’t care much about market volatility and economic downturns because no matter how much the stock market declines, you will not sell in the dip and you’ll keep investing.

• Dollar Costing Average:

Dollar costing average is an investment strategy in which investors divide the amount they are willing to invest across the years of investment.

In other words, let’s say you have $12,000 ready to be invested, and you bought stocks with the full amount.

Suppose that afterward, the price of the stock you bought dropped significantly; in this case, you will have to either sell at a loss or wait for the prices to pick up back to the point you bought it, even though it might take a long time. In both ways, you will lose either money or time.

Alternatively, you could’ve split your investment into monthly contributions and invested the $12,000 over one year. For example, you could’ve invested $1,000 every month for a year.

This way, if the market went down after your first $1,000 contribution, it’s totally fine because you will invest the second $1,000 at a lower price.

Again if the price drops after your second buy, you will keep on buying at the lower price.

Once the price starts to go up, you would begin making a profit without waiting for the price to be back to the price you made your first purchase because you already averaged your buying price.

• Change Your Perspective of Stock Market Downtrends:

Usually, when the stock market drops, so many people panic and rush to sell so they can limit their losses and reduce damages.

But for smart investors, those times are the best times to increase the investments. Stocks are on discount, and it’s shopping time.

Eventually, that stock market will pick up no matter how long the downtrend lasted, and whoever bought at the low prices will probably make decent returns.

Remember that this is why it is crucial to keep some cash in the saving account, sitting there and waiting for any discounted stocks opportunity.

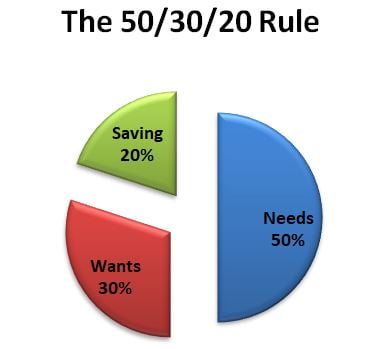

In general, financial advisors recommend no less than 15%-20% of your income to be invested. However, the more you are able to save and invest, the earlier you will be able to retire and to live financially free.

For sure, you’ve heard of the famous saying, “don’t put all your eggs in the same basket.” This saying never gets old and can’t be more accurate when it comes to building your stocks portfolio.

1. Market Diversification:

It’s always recommended to diversify your investments across several geographic places. This way, you minimize the risk of losing your money if any turbulence occurred to that specific region.

Below you can see some of the regions that have a solid and promising stock market with a high growth potential that you can split your investment across:

• US Stock Market

• Asian Stock Market

• UAE Local Stock Market

After deciding on the geographic regions, you need to consider adding different types of stocks and not relaying on one type.

Here are the stocks types anyone needs to have in their stocks investing portfolio.

2. Stocks Types Diversification

• Large Cap, Mid Cap, and Small Cap Companies:

Investing in one size of companies will not give you the diversification you seek; hence it’s very important to have large, mid, and small-cap companies in your portfolio. The percentage of how much to invest in each group depends on your risk appetite.

Usually, large-cap companies are safer and less volatile than small caps and most likely to always remain there, but they offer lower growth potential than the small-cap companies as those companies have high risk and still in the growth stage of their lives.

Examples:

Large Cap Companies: Amazon (NASDAQ: AMZN), Apple (NASDAQ: AAPL)

Mid Cap Companies: Fastly (NYSE: FSLY), Beyond Meat Inc (NASDAQ: BYND)

Small Cap Companies: GameStop Corp (NYSE: GME)

• Defensive Stocks:

Defensive stocks are stocks that are not very sensitive to economic volatility.

These companies usually manage to sell their goods and services regardless of the state of the economy.

Example of defensive stocks: Coca Cola (NYSE: KO), AT&T Inc. (NYSE: T)

• Dividend Stocks and Growth Stocks.

Some companies pay you part of their profits for simply holding their stocks, which is called dividends, while some other companies prefer not to distribute any profit and invest the money back to the business.

Even though both dividend and growth stocks have their pros and cons, having both of them in your portfolio is highly recommended.

Read more: Dividend stocks vs. Growth stocks.

To buy US stocks from the UAE, you need to open a brokerage account. Multiple brokers allow you to buy stocks while residing in the UAE.

List of Brokers:

*Note: This list doesn’t necessarily cover all brokers in the market.

Each of the mentioned brokers has its pros and cons. Also, there are many factors to consider before deciding on the broker, such as experience level, the platform’s complexity, frequency of trades you place.

After carefully trying multiple brokers, we can recommend eToro for stock investing.

eToro offers a zero-commissions stock and ETFs. The platform is straightforward and user-friendly, especially if you are a beginner.

Whether you are starting your investing journey or you are an experienced investor, eToro is an exciting platform and available in more than 140 countries all over the world.

Whether you are starting with a big amount of money or small, just do it and don’t wait for the “right moment” because it’s difficult to time the market. Diversify your portfolio, use the strategies mentioned in this article and enjoy the journey.

Do remember that time in the market is more important than timing the market.