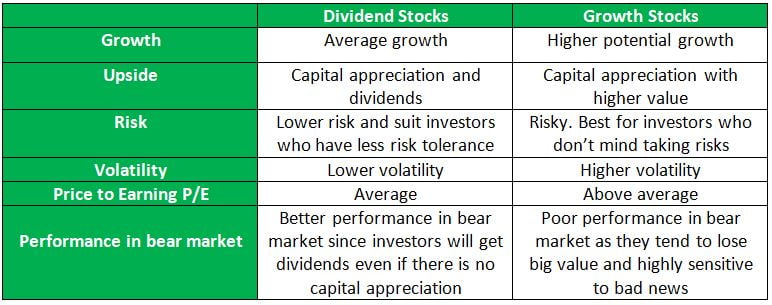

Dividend Stocks vs Growth Stocks

Both dividend stocks and growth can be good options, but it all depends on your investment objectives. This article will explain what dividend and growth stocks mean and the major differences between them.

What is Dividend Stock?:

The dividend is a portion of a company’s profit paid out to shareholders on a specific date. It can be annually, quarterly, or even monthly.

Not all companies distribute part of their profits as dividends; some of them prefer to retain it.

Usually, newly established and high-paced growth companies prefer not to pay dividends and hold their profits to reinvest in the business.

In contrast, well-established companies with high market shares might distribute part of their profits to investors since the company’s operating cycle can finance the investments and expansion plans. They usually have enough cash to distribute.

How do dividends work?:

Suppose you bought 50 shares of Coca Cola (KO). The company announced that it would pay $0.5 for each share investors are holding.

To calculate how much dividends you will receive in that quarter, multiply the numbers of shares you are holding by the dividend per share:

50 shares * $0.5 = $25

Companies normally pay the dividends to your brokerage account.

What is Growth Stocks?:

A growth stock is a company that delivered higher growth rates than the average and can continue providing high levels of earnings.

Growth stocks usually are priced higher than the average because investors are willing to pay a higher price to earnings (P/E) as they expect those earnings to grow fast soon.

Generally, growth stocks pay either modest dividends or zero dividends at all. The reason behind paying no dividends is that growth stocks are growing rapidly and usually tend to reinvest their retained profits back into the business to maximize its revenue-generating potential.

Bottom Line:

Both growth stocks and dividend stocks have pros and cons. They both can deliver decent returns. However, deciding what could be better than the other is completely depends on every person’s goals, risk appetite, and time horizon to retirement.