5 ETF Portfolio Ideas You Can Start from the UAE

Do you want to invest in ETFs but you don’t know where to start?

Read this article till end, and when you finish, you will be able to build one or more ETF portfolios as per your favorite themes.

The ETF Portfolios we will build in this article are the following:

1. Technology & Blockchain ETF Portfolio

2. Healthcare ETF Portfolio

3. US Stocks & Bonds ETF Portfolio

4. High Dividend & Income ETF Portfolio

5. Electric & Self Driving Cars ETF Portfolio

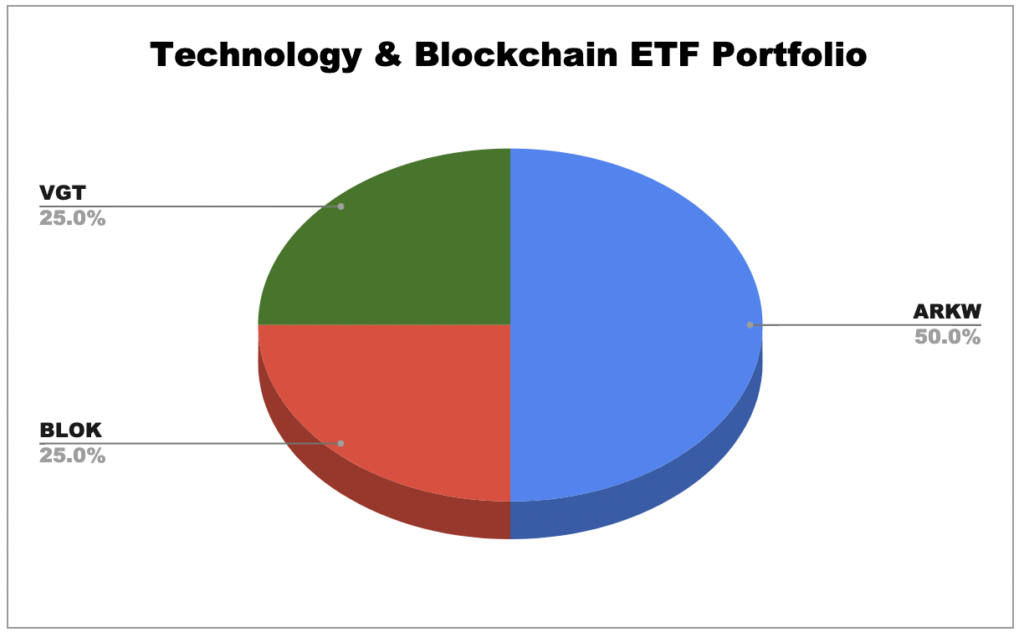

If you want to invest in the technology sector, as well as the blockchain technology, but you are not sure which stocks to buy, or which companies are the best to invest in, the you need to consider copying this portfolio, or building a similar one.

Number of ETFs: 3 ETFs,.

Risk Profile: High Risk

The ARK Next Generation Internet ETF (ARKW) invests in the companies that are creating the next generation of the internet. The advisory firm, led by Catherine Wood, has an impressive track record doing what most stock pickers fail to do: beating the market.

5 Years Performance: 602%

Popular Holdings: Tesla, Twitter, Zoom, Shopify

ETF Symbol: ARKW – 50%

This ETF is one of a handful of funds that invests in businesses involved in blockchain, the technology behind cryptocurrencies like Bitcoin.

3 Years Performance: 162%

Popular Holdings: Coinbase, Paypal, Microstrategy

ETF Symbol: BLOK – 25%

This ETF tracks a broad index of companies in the information technology sector which the company considers to be the following three areas; software, consulting, and hardware.

5 Years Performance: 277%

PopularHoldings: Apple, Microsoft, Google, Visa

ETF Symbol: VGT – 25%

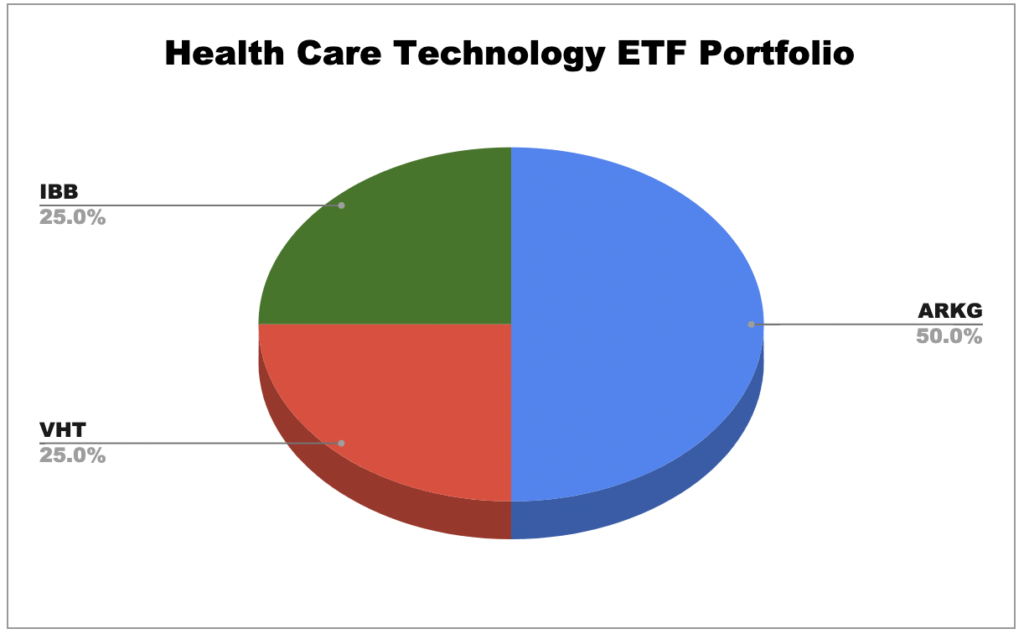

If you believe that the future will be promising for the healthcare industry, and the technology of vaccines, medicines and medical machines, then you should consider copying, or building a similar to this portfolio.

Number of ETFs: 3 ETFs,.

Risk Profile: Moderate Risk

The Fund seeks long-term growth of capital. The Fund is an actively-managed exchange-traded fund that will invest under normal circumstances primarily in domestic and foreign equity securities of companies across multiple sectors, including healthcare, information technology, materials, energy and consumer discretionary.

5 Years Performance: 400%

Popular Holdings: Teladoc, Pacific Biosciences

ETF Symbol: ARKG – 50%

The Fund seeks to track the performance of a benchmark index that measures the investment return of health care stocks; specifically the MSCI U.S. Investable Market Health Care Index. This is an index of stocks of large-, mid-, and small-size U.S. companies within the health care sector.

5 Years Performance: 110%

Popular Holdings: Pfizer, Moderna, J&J

ETF Symbol: VHT – 25%

The iShares Biotechnology ETF seeks to track the investment results of an index composed of U.S.-listed equities in the biotechnology sector.

5 Years Performance: 84%

Popular Holdings: Moderna, Gilead, Illumina

ETF Symbol: IBB – 25%

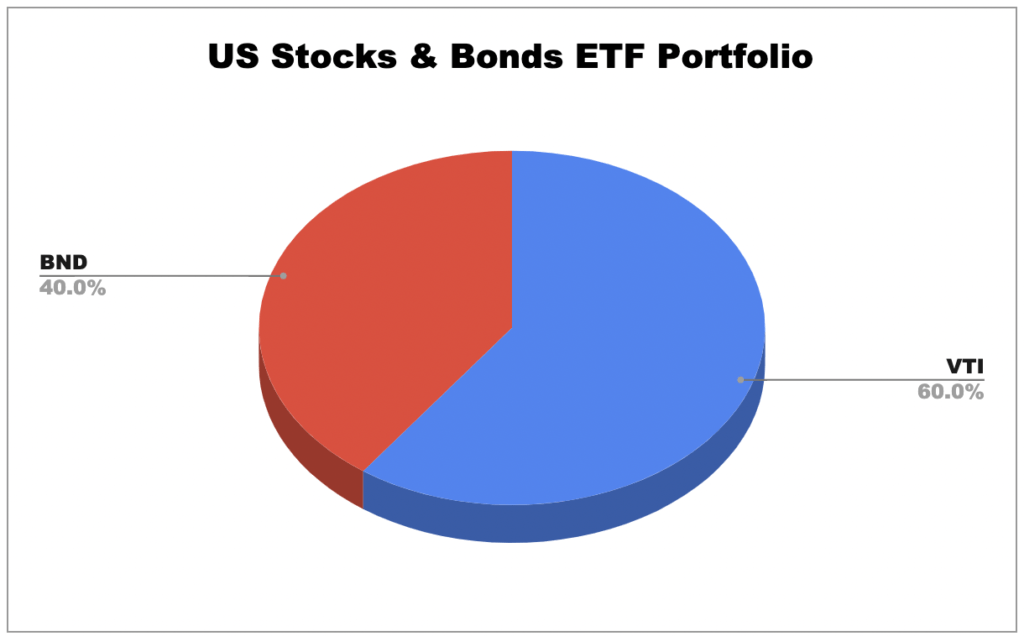

If you are looking for the peace of mind, and for a portfolio that you can keep investing in for the next 5,10,20 or even 25 years, then this simple portfolio is ideal for you. It invests in US stocks and bonds.

Number of ETFs: 2 ETFs,.

Risk Profile: Depends on allocation. The higher you allocate on stocks, the higher the risk will be, while the higher you allocate on bonds, the safer this portfolio will be.

This ETF offers broad exposure to the U.S. equity market, investing in thousands of different securities across all sectors. When you invest in this ETF, it’s like you are buying stocks of the whole market of US.

5 Years Returns: 125%

Popular Holdings: Microsoft, Apple, Tesla, JP Morgan, Visa

ETF Symbol: VTI – 60%

This popular ETF offers exposure to entire investment grade bond market in a single ticker, with holdings in T-Bills, corporates, MBS, and agency bonds. While it holds securities of all maturity lengths, it is heavily weighted towards the short end of the curve.

5 Years Returns: 16%

Popular Holdings: Mix of short and long term US Treasury and Corporation Bonds

ETF Symbol: BND – 40%

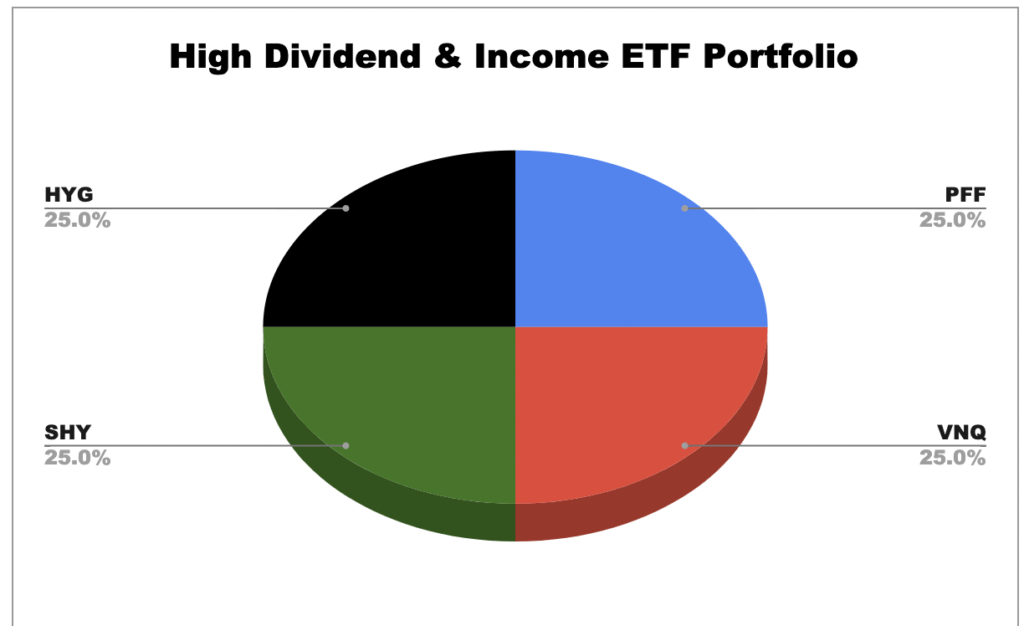

If you are a dividend investor, and looking for a portfolio that can generate income, the this ETF portfolio is best for you. It invests in high yield dividend generating assets.

Number of ETFs: 4 ETFs,.

Risk Profile: Moderate

This ETF gives investors exposure to preferred stocks. Holders of preferred stocks are “preferred” over the regular stock holders, and they are the first people to receive dividends when the company liquidates it’s assets.

5 Years Performance: 27%

Popular Holdings: Bank of America, Citigroup

ETF Symbol: PFF – 25%

This ETF Invests in stocks issued by real estate investment trusts (REITs), companies that purchase office buildings, hotels, and other real property. it offers high potential for investment income and some growth; share value rises and falls more sharply than that of funds holding bonds.

5 Years Performance: 46%

Popular Holdings: American Tower, Vanguard Real estate index funds

ETF Symbol: VNQ – 25%

The iShares 1-3 Year Treasury Bond ETF seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities between one and three years.

5 Years Performance: 8%

Popular Holdings: Short Term Treasury Bonds

ETF Symbol: SHY – 25%

The iShares iBoxx $ High Yield Corporate Bond ETF seeks to track the investment results of an index composed of U.S. dollar-denominated, high yield corporate bonds.

5 Years Performance: 30%

Popular Holdings: High Yield Corporate Bonds

ETF Symbol: HYG – 25%

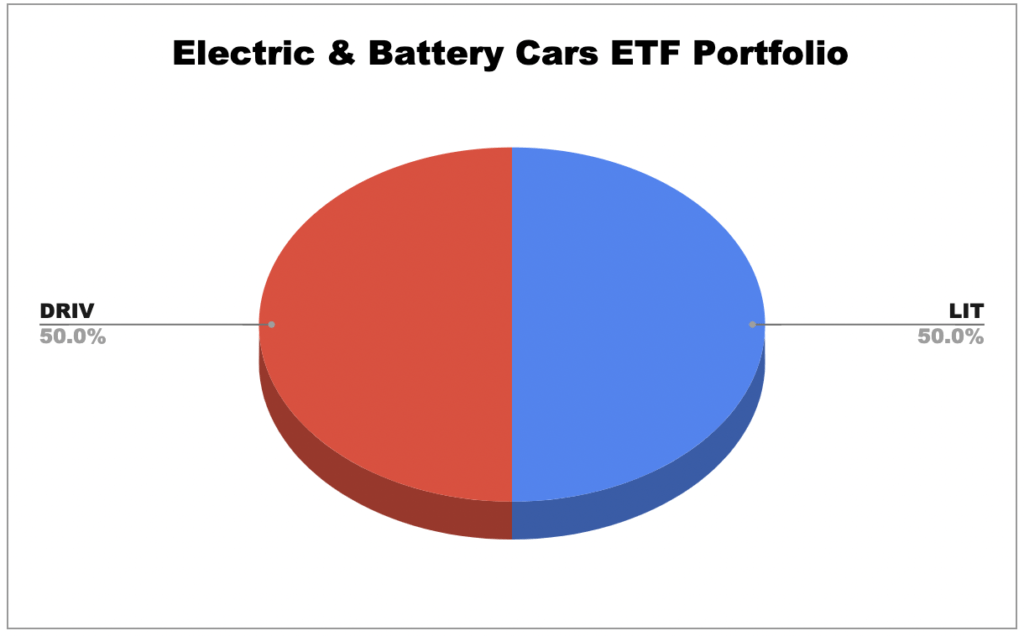

If you think that the future will be promising for the electric cars, battery cars and the self-driving cars industry, then you can copy this ETF portfolio or build a similar one.

Number of ETFs: 2 ETFs,.

Risk Profile: High

The Global X Lithium & Battery Tech ETF (LIT) invests in the full lithium cycle, from mining and refining the metal, through battery production.

5 Years Performance: 274%

Popular Holdings: Tesla, Samsung

ETF Symbol: LIT – 50%

The Global X Autonomous & Electric Vehicles ETF (DRIV) seeks to invest in companies involved in the development of autonomous vehicle technology, electric vehicles (“EVs”), and EV components and materials. This includes companies involved in the development of autonomous vehicle software and hardware, as well as companies that produce EVs, EV components such as lithium batteries, and critical EV materials such as lithium and cobalt.

3 Years Performance: 100%

Popular Holdings: Toyota, Tesla, Google

ETF Symbol: DRIV – 50%

If you are willing to invest in ETFs from UAE, you can either do it yourself through brokers, or through an expert financial advisor where you both discuss the strategy and theme you are willing to invest in.

1. Invest in ETFs by your own:

To buy ETFs in UAE by yourself, you must have an account with a brokerage firm registered with the exchange where you want to trade ETFs.

One of the most famous brokers to invest in stocks and ETFs in Dubai are:

2. Invest in ETF through a Financial Advisor

If you don’t know how to do it yourself, or you don’t have the time to research and monitor the news and markets, you can use the help of a financial advisor. It’s their job to be always updated with market trends and potential opportunities. You will explain to them your goals and risk appetite, and they will create an ETF portfolio for you and they’ll review it periodically with you.

You can do your own research to find the best financial advisor in UAE. Also, you can check our recommended list. We chose this list carefully based on popularity, good reviews, the strength of the companies they work for, and the range of products and solutions they provide.